CPP: Faster move brings great success

If oil means blood to a country, pipelines are like vessels.

In China, a company that built eight out of 10 such vessels is the China Petroleum Pipeline Bureau (CPP).

Established in 1973, CPP is a wholly owned subsidiary of China National Petroleum Corporation (CNPC), China's leading integrated energy company.

Its main business includes the construction and operation of long-distance oil and gas pipelines, oil storage tanks, telecommunication and liquefied natural gas (LNG) utilization.

As a company with overseas operations, CPP has constructed more than 36,000 kilometers of pipelines for various medium at home and abroad.

In domestic market, CPP has undertaken more than 85 percent of the pipeline construction and built more than 500 oil storage tanks with a capacity of over 10 million cubic meters.

The lengths of pipelines crossing over large rivers such as the Nile, the Yellow River, the Yangtze River and the Songhua River have accumulated to be more than 200 kilometers long.

Expanding connections

The office building of the CPP |

The branch runs from south to north, connecting the Qingshan Distributing Station on the trunk of the West-East Gas Pipeline to Anping Distributing Station on the parallel Shaan-Jing (Shaanxi-Beijing) Pipeline.

The 886-kilometer-long trunk pipeline connects the West-East Pipeline to the Shaan-Jing Pipeline and allows transportation adjustment between these two pipelines.

CPP's overseas operations are spreading across the Middle East, Far East, the Asia-Pacific, Africa and South Asia. CPP has more than 11 overseas offices or subsidiaries in Sudan, Libya, the UAE, Kuwait, Iraq, Tunisia, Mozambique, Thailand, India, Algeria and Kazakhstan, in which more than 40 EPC (engineering, procurement and construction) projects have been accomplished and more than 15 construction or other service projects are ongoing.

These include the Sino-Kazakh Oil Pipeline, a crude pipeline from Sudan's Block 3/7 to Sudan Port, a pipeline for the combined transportation of oil and gas in Kazakhstan's Kenkijak oilfield , and the Zhanazhol-KC13 gas pipeline.

Into India

CPP workers on the pipeline field of the West-East Gas Transportation Pipeline Project, which transports clean fuel from Xinjiang Uygur Autonomous Region to the energy-hungry Yangtze River Delta. |

Because of the outstanding performance of the projects both in China and overseas by CPP, the owner of EWPL - Reliance Industry Limited, one of the largest private companies in India - has finally chosen CPP as the main contractor for undertaking the majority of the pipeline project.

The project is comprised of a 1,386-kilometer mainline, dispatch compressor stations, intermediate compressor stations, mainline valve stations and tap-off stations.

EWPL originates at the Onshore Gas Processing Terminal (OGPT) of Reliance Industries Limited, located in the state of Andhra Pradesh. The OGPT pipeline traverses through the states of Andhra Pradesh, Karnataka, Maharashatra and Gujarat and terminates near Bharuch in the state of Gujarat.

On May 21, 2006, Reliance Gas Transportation Infrastructure Limited (RGTIL) finally and formally confirmed their award to CPP for the construction of pipelines and associated facilities with total length of 1,088 kilometers.

In addition, CPP was awarded on the same day to undertake the work of design, engineering, fabrication, testing, installation and idle preservation of a gas pipeline across the rivers of Narmada, Tapi, Kim, Purna, Ambika, and Mindola.

Industry leader

CPP's recognition in the pipeline field comes from its leading position in the industry due to its comprehensive capability in terms of its equipment, advanced technology, intellectual property rights and management.

CPP owns sufficient construction equipment, including pipe-laying equipment, semi-automatic and automatic welding machines, horizontal directional drilling (HDD) rigs, soil trench excavators, swamp excavators, low boys, piling rigs and other heavy construction equipment.

Along with its investment in equipment, CPP has advantages in the qualifications it has obtained. So far, these include the special grade qualification for Petrochemical Project Contractor issued by the Ministry of Construction; qualification for International Economic Cooperation and Business and Import and Export; Class A qualification in Pipeline Project Survey, Design, Supervision, Consultancy and PMC (project, management, consultant); first-class contractor of Communication Project and A1 certificate of producing pressured container.

Troubles and reform

CPP's leadership in natural gas and pipeline construction and transportation started after the company recomposed in 1999.

In the early days of the recomposition, CPP was facing a very difficult time. With more than 38,000 employees, the company was overweight. About one third of them were administrative staffs.

Moreover, their products were in poor quality, and did not sell well. Product technology is way behind the industrial level as some equipment was below even the lowest standard issued by the country's authority. Its assets were unevenly structured, with production assets only accounting for 16.8 percent of its total.

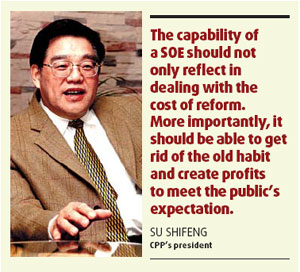

The turning point came as Su Shifeng, CPP's president, decided to reform and reconstruct the company, introducing the market economy concept into its operation.

"CPP will not live on left-behind technology and settle for the old equipment," said Su. "We are not going to be the president of the 'maintenance club.' Recomposing is a challenge and an opportunity for us.

"The capability of a State-owned enterprise (SOE) should not only reflect in dealing with the cost of reform. More importantly, it should be able to get rid of the old habit and create profits to meet the public's expectation."

Su started to change the minds of people who were still in the planned economy era. CPP had called for discussions on the theme of "survival and development" among its staff. The move had a great impact on the employees' concepts and inspired desire and incentives for creation and development. Following that, CPP worked on adjustment in production, human resources and assets.

The reform was successful, as CPP has gained profit since 2000, with its margin exceeding 100 million yuan in 2003, 25 times that in 2000. Employees' salaries have jumped 53 percent from 2000 to 2003.

CPP's State-owned net assets grew to more than 2 billion yuan from 2000 to 2003. In 2003, CPP's revenue reached 4.81 billion yuan, 2.2 times that of 2000.

But it is only a beginning for CPP's ambition in expanding its pipeline business kingdom.

Pursuing partnership

Focused on the design and construction and transportation for refinery oil and petrol, CPP has invested 1.15 billion yuan on its core business in recent years. It has purchased more than 2,000 sets of advanced facilities. As a result, overall managerial and production assets have risen to 57 percent in 2003 from 16.8 percent in 1999.

Partnership is considered a way for CPP to become stronger. The company had jointly worked with the China Pipeline Company, a subsidiary of the CNPC, in expanding their market presence in the upper-stream products overseas. CPP also has been in collaboration with big foreign companies, particularly those in designs.

In addition, CPP has broadened its business territory to the sea by developing sea projects and purchasing more facilities that can be used on the sea.

"A SOE's responsibility is not only to explore the domestic market, but more importantly, to develop the overseas market," Su said.

(China Daily 01/26/2007 page20)