LeEco in damage-control mode

|

|

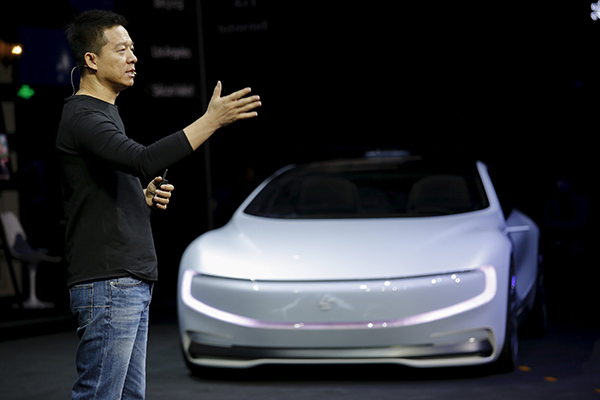

Jia Yueting, co-founder and head of Le Holdings Co Ltd, also known as LeEco and, formerly, as LeTV, gestures as he unveils an all-electric battery "concept" car called LeSEE during a ceremony in Beijing. [Photo/Agencies] |

Jia reassures that cash flow crunch will be sorted out; swears by e-car investments

Tech-to-auto major LeEco said it would resolve its cash flow crunch within three to fourth months.

"We have tackled 60 to 70 percent of our capital problems. The business will return to normal in three to four months," Jia Yueting, CEO of LeEco, said in an interview with Chinese magazine China Entrepreneur on Sunday.

In response, shares in Chinese smartphone maker Coolpad Group Ltd, in which LeEco holds a more than 28 percent stake, jumped 1.39 percent on Monday to close at HK$0.73 ($9 cents).

LeEco also said it would unveil in January its first electric car model that will be mass-produced.

Founded in 2004, LeEco started as a video-streaming service provider, akin to Netflix Inc of the United States.

It evolved rapidly into a diversified group with a presence in smartphones, TVs, cloud computing, sports and electric cars.

But after launching operations in the US in October, the Beijing-based group found itself short of cash.

That was because "its expansion efforts have gone too far", Jia said in a public letter last month. LeEco has been facing mounting doubts about its electric car project which has already cost the company over 10 billion yuan ($1.45 billion).

"We won't change our ambition in electric cars. It is the second most important business unit in LeEco, only after our listed arm," Jia said in the interview.

According to him, the car LeEco will unveil in January can run faster than Ferrari models. LeEco plans to mass-produce the car in as early as 2018. But, it did not disclose how many cars it would produce at the initial stage.

In August, LeEco said it would invest 20 billion yuan to build an auto park in Zhejiang province, as part of the group's broad plan to mass-produce electric cars.

According to the local government website, LeEco has recently bought a 900,000-square-meter land in Deqing county, Zhejiang province, for 279 million yuan, to set up the production base for its electric automobiles.

Lu Zhenwang, CEO of the Shanghai-based Wanqing Consultancy, said electric cars constitute an investment-intensive sector. Without persistent capital support, it can't grow into a cash cow.

"It remains to be seen how LeEco can live up to its promise. After all, dozens of billions of yuan are needed to build a factory. And I don't think LeEco has enough cash in hand now," Lu said.

As a greenhorn in the car industry, LeEco will likely find the task of dealing with the complicated manufacturing process and safety issues highly challenging, he said.

In fact, the US-based electric car startup Faraday Future, which is backed by LeEco, is already having trouble in its $1 billion factory plan in Nevada.

In a recent interview with China Daily, Nevada State Treasurer Dan Schwartz expressed concern.

"The projects Jia invested in, including in China, seem very difficult for him personally to realize. If you look at Leshi (LeEco's listed arm), it has roughly $6 billion in revenue, but it's netting about $50 million in profit. That profit margin is less than 1 percent ... Grocery stores make 2 percent to 3 percent," Schwartz said.

Trading in shares of Leshi Internet Information and Technology Corp remained suspended on the Shenzhen Stock Exchange on Monday, after the company said last Wednesday it was investigating why its stock price plummeted more than 7 percent the day before.

Fan Feifei contributed to this story.