|

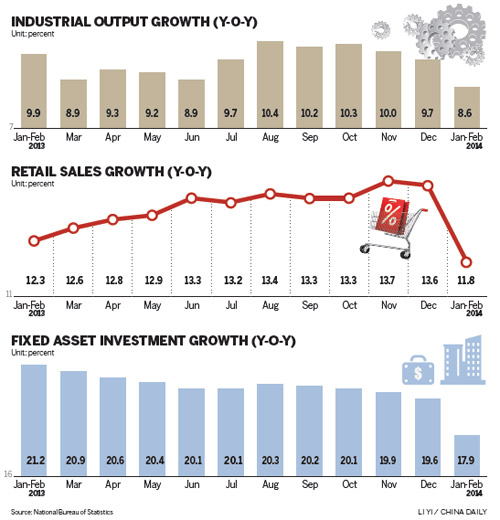

He expected growth momentum to be weaker in the first quarter, but a return should come after April, with stable GDP growth of about 7.6 percent maintained for the whole year.

"Big driving forces for economic growth will come from the market's endogenous dynamic, which will be further stimulated by restructure reforms," Xu said. "For example, small and micro enterprises are expected to receive more supports from cutting taxes. And financial reform will inject more private capital to help developing industrial economy."

|

|

|

|

Premier Li Keqiang expressed confidence at a news conference after the close of the National People's Congress meeting on Thursday that the nation will meet the flexible growth target of about 7.5 percent this year.

In order to achieve the target, Liu Ligang, chief economist in China at the ANZ Bank, said the central bank may need to cut its reserve requirement ratio and adjust monetary policy to a more proactive stance.

But Lu Zhengwei, a senior economist at Industrial Bank, predicted that the People's Bank of China is unlikely to cut the RRR until April, as the currency market liquidity is relatively sufficient.

Louis Kuijs, chief economist in China at Royal Bank of Scotland, said it won't be necessary for the government to pursue expansionary policies even if GDP growth threatened to fall to between 6.5 percent and 7 percent.

With a benign outlook supported by domestic growth drivers and improving global demand, the government can succeed in cool the rise in the credit-to-GDP ratio while protecting its bottom line on growth, he said. "Such a scenario would be welcomed by financial markets and good for financial asset prices."

But if the downward pressures persists, Kuijs expects the government to look for ways to support growth, and the best way could be via pure fiscal policy — "with central government spending rising, financed by bond issuance", as there is not much room for monetary stimulus.