Energy giants 'in merger talks'

|

|

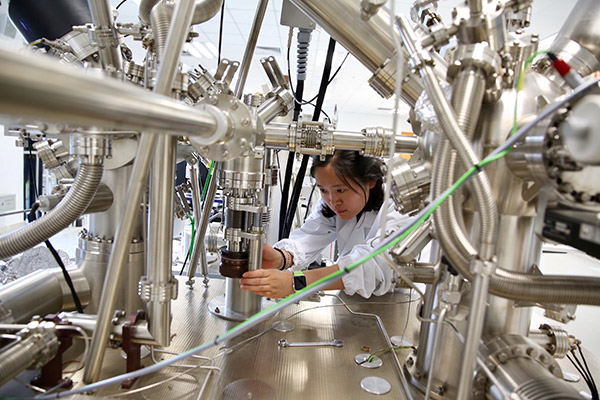

A researcher works on catalyst for coal-to-liquids technology at a research institute in Beijing. [Photo/Xinhua] |

The listed units of Shenhua, Guodian halt trading in shares

China's largest coal miner and a coal-fired power giant are reported to be in merger discussions, as their listed units halted share trading on Monday.

China Shenhua Energy Co said in a filing on Sunday to the Hong Kong Stock Exchange that it was informed by parent company-China's largest coal miner Shenhua Group Corporation-of "significant matter containing substantial uncertainty which is subject to the approval of the relevant authorities".

On the same day, Guodian Technology and Environment Group, the listed unit of China Guodian Corp, one of the nation's largest coal-fired power generators, issued a similar statement, saying it was informed of the "proposed planning of a significant event".

It is believed the two energy giants are in merger discussions despite neither of them responding to requests for comment.

A merger of the energy giants would see the creation of a bigger and more competitive State-owned enterprise in the global market, said Zhou Dadi, a senior researcher at the China Energy Research Society.

Wu Qi, an analyst from the commercial bank research center at the research institute of Hengfeng Bank, said that the merger of a power generator and a coal miner is a win-win solution that takes advantage of both sides.

Economies participating in the Belt and Road Initiative see massive shortages in power generation and supply, and the merger will help the Chinese company better penetrate foreign markets, Wu said.

China has vowed to further cut its industrial overcapacity to accelerate restructuring of the nation's huge SOE sector.

Peng Huagang, deputy secretary-general of the State-owned Assets Supervision and Administration Commission, said last week at a news conference that the government plans to focus on the restructuring of the coal, power, heavy equipment manufacturing and steel sectors, and explore overseas asset integration.

China is also considering merging two of its nuclear power giants, as the Shanghai-listed units of China National Nuclear Corp and China Nuclear Engineering Corp Group said earlier in March that a strategic reorganization of the companies is underway.

China's 102 centrally administered SOEs made a combined profit of 825 billion yuan ($121.44 billion) during the first four months of 2017, up 24.8 percent year-on-year, according to the Ministry of Finance.

Lin Boqiang, head of the China Institute for Energy Policy Studies at Xiamen University, warned that in addition to increased competitiveness in the international market, there might also be excessive concentration that damages domestic market competition.

It might not have a substantial impact on turning the energy companies' losses into gains, he said.