China's November trade data shows positive signs while outlook remains challenging: Economists

BEIJING - Analysts from around the world hail a strong rebound of China's trade data in November, as both domestic and global demands show signs of recovering.

Stripping out the impact of yuan depreciation, exports in US dollar terms edged up 0.1 percent year-on-year in November, according to data released Thursday by the General Administration of Customs. The latest export figure represented the first increase in nine months following a 7.3 percent contraction in October.

Meanwhile, November imports grew by 6.7 percent year-on-year, the fastest pace in more than two years following a 1.4 percent decline in October, customs data showed.

"Better-than-expected trade data out of China today reflects both an uptick in global demand as well as the continued strength of domestic economy," wrote Julian Evans-Pritchard, China economist at Singapore-based Capital Economics, in a note.

The upbeat data "adds to signs of a modest industrial recovery in the world's largest economies even as China and other Asian exporters brace for a potential trade war once protectionist US President-elect Donald Trump takes office," Reuters reported.

Moreover, analysts pointed out that the recent depreciation of the Chinese yuan also contributed to the rebound.

November's trade gains were even stronger when measured in China's currency. In yuan terms, exports rose 5.9 percent from a year earlier while imports continued to pick up steam by increasing 13 percent.

With the deepening of supply-side reform and a low price base, imports may sustain growth, said Niu Li, an economist with China's State Information Center.

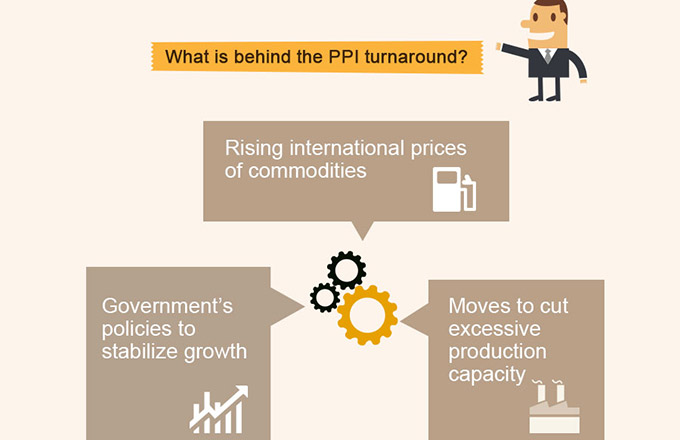

Improving fundamentals and recovering commodity prices such as crude oil and iron ore in the global market also contributed to the positive trade data in November, economists said. But some believe the sharp commodity price rises could mask a still sluggish demand.

The better-than-expected trade figures cement expectations that the Chinese government will once again meet its full-year growth target, which was set at 6.5 to 7 percent for this year, Reuters reported.

Despite the November bounce, analysts expressed concerns about the sustainability of strength in China's trade, as risks of receding trade globalization might weigh on future growth.

"Of all the high frequency economic data over the year, trade headwinds are likely to be the most severe, and the most uncontrollable, due to trade policies of other countries," Chester Liaw, an economist at Forecast Pte Ltd in Singapore, was quoted by Reuters as saying.

The medium-term outlook for Chinese trade "remains challenging," Evans-Pritchard noted. "While global demand has recovered somewhat recently, lower trend growth in many developed and emerging economies means that further upside is probably limited."

Mounting trade tensions with the United States and Europe could weigh on Chinese exporters in the coming months as Donald Trump assumes the US presidency, the Wall Street Journal quoted Standard Chartered Bank economist Ding Shuang as warning.

During his campaign, Trump pledged to impose sanctions against China, saying he would brand China a currency manipulator and impose heavy tariffs on imports of Chinese goods.

Even if Trump does not try to impose punitive measures, growing protectionist sentiment could have "a chilling effect" on trade and investment worldwide, Reuters reported.

"We remain cautious on the export outlook, given the still unconvincing global demand recovery and policy uncertainty in the US after Mr Trump's election win," Louis Kuijs of Oxford Economics told the Associated Press.