|

|

A boy plays with giraffe-shaped Lego bricks at a toy fair in Hangzhou, Zhejiang province. ZHU YINWEI/CHINA DAILY |

Local brands, global majors slug it out as sales are expected to rise in the wake of the end of the one-child policy

The end of China's one-child policy and rising demand for quality toys are expected to boost sales of children's play products like toys and games.

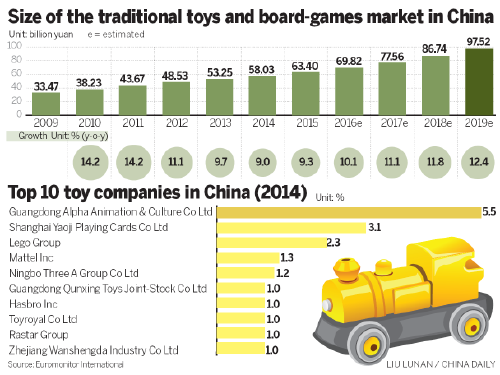

Sales are projected to climb to 97.52 billion yuan ($14.98 billion) by 2019 in China, according to industry data.

According to Euromonitor International, toy sales reached 58.03 billion yuan in 2014 and 63.4 billion yuan in 2015, and are likely to net 69.82 billion yuan this year.

Clover Wei, senior associate at EI, said sales of traditional toys and games in 2014 and 2013 grew but at slower rates of 9 percent and 9.7 percent, respectively.

That's because sales of products for kids, like action figures, accessories, arts, crafts, dolls, dressing-up and role-play kits, games, puzzles and plush toys, witnessed slower growth in 2014 due to economic slowdown and rising popularity of video games.

On the other hand, products that encourage children to participate in outdoor activities sold well in 2014. Outdoor activity products and sports toys, radios, remote control toys and ride-on vehicles benefited from the trend, according to Wei.

"Parents are increasingly aware of the academic workload their children bear, and they believe products that require children to play outdoor can effectively relieve their stress," she said.

Moreover, teamwork and team spirit are possible through outdoor activity, sports toys, radios and remote control toys, she said.

Domesic toy brands have dominant market positions. Guangdong Alpha Animation & Culture Co Ltd took the biggest retail market share of 5.5 percent in 2014, followed by Shanghai Yaoji Playing Cards Co Ltd with 3.1 percent.

Guangdong Alpha competes in multiple segments of the children's products market, including toys, games, animations and cartoon series.

The company also owns a television channel called Jia Jia Cartoon, which broadcasts user-directed cartoon series such as Battle of King II and Blazing Teens VI.

Its strong presence in traditional toys and games is a result of the extensive product portfolio it has built up over the years, covering both non-animated and animated traditional toys across 12 categories, including action figures, construction toys, dressing-up and role-play kits, games and puzzles.

The company positioned itself in the mid-market niche. Its extensive distribution channels and the comparatively lower prices gave it an edge over competitors.

In animated toy products, sales of the Battle of King spinning top and the Blazing Teens yo-yo rose in 2014, thanks to the launch of animated cartoon series, the Battle of King II and Blazing Teens VI and increasing popularity of outdoor toys, said Wei.

The cartoon videos gave Guangdong Alpha's outdoor toys a competitive edge in the market.

Lego Group from Denmark has outpaced other international brands in China. It ranked No 3 with a 2.3 percent market share in 2014, thanks to its focus on Asia.

Lego is building its first factory in Jiaxing in East China's Zhejiang province to serve the increasing demand for its products across Asia. The facility already has more than 230 employees. Their number is expected to grow to 600 by the end of this year. The factory will become fully operational in 2017.