Local financing vehicles' repayment won't be guaranteed, premier says

Ratings agencies have warned that the risk of defaults in China has risen as Premier Li Keqiang pares implicit guarantees for local government financing vehicles.

The yield premium over the sovereign for three-year AA corporate bonds, the most common grade for LGFVs, widened 21 basis points from last month's four-year low to 199 bps last Friday.

The yield on the nation's 10-year sovereign debt was 3.98 percent on Sept 30, compared with 4.56 percent on Dec 31.

The State Council said on Oct 2 that the finance arms can no longer raise funds for local authorities and that the governments have no obligation to repay debt that was not raised to fund public projects. China International Capital Corp has forecast higher yields for new sales, while China Lianhe Credit Rating Co, a Fitch Ratings joint venture, said it cannot rule out the possibility of defaults.

"The market is entering a new era," said Chen Jianheng of CICC. "The time when everybody bought LGFV bonds for high returns without considering credit risks is over. For any sales in the future, investors will apply a different set of criteria."

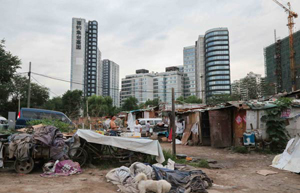

Li has accelerated budget reforms in the past year as a borrowing surge that started after the 2008 global financial crisis prompted economists to compare it to the problems that tipped Asian nations into repayment troubles in the late 1990s. Local government liabilities, equivalent to 30 percent of GDP by a Fitch estimate, grew 67 percent from the end of 2010 to 17.9 trillion yuan ($2.9 trillion) as of June last year, according to a State audit.

Creditors and debtors should work together to identify existing LGFV bonds that governments have repayment obligations on, according to the State Council statement on the central government website. Such debt will be included in local budgets and can be replaced by new, lower-cost issues, while the rest is subject to repayment failure, it said.

Apart from public projects, the funding vehicles also raise money for private sector.

LGFVs issued 1.7 trillion yuan of debt this year, exceeding the 1.16 trillion yuan issued in 2013, data compiled by Bloomberg show. Repayments will amount to 250 billion yuan a year in 2014-15, and may rise to 350 billion-400 billion yuan in 2016-17, according to Lianhe Credit Rating estimates.

"LGFVs' profitability is weak, and given the huge repayment pressure, there's the possibility that certain bonds are likely to default on a lack of government endorsement," Liu Xiaoping, director of credit rating at Lianhe, wrote in a report.

Fiscal and tax reforms came into focus after the Third Plenum in November 2013, which promised to give markets a "decisive" role. This August, lawmakers passed an amendment to the budget law to clear legal hurdles for local governments to issue bonds directly.

A ban on such borrowings in a 1994 version of the law led to the establishment of thousands of financing companies to fund the building of sewers, roads and bridges. The World Bank estimated that regional administrations are responsible for about 80 percent of spending while receiving only 40 percent of tax revenue.

In an effort to streamline the process, the Finance Ministry expanded a trial of municipal note sales to 10 provinces and cities this year from six in 2013, and regulators approved issues of revenue bonds linked to specific projects.

|

|

|

| Municipal bonds to fund urbanization push | China targets local gov't debt risks with new rules |