|

|

Employees attend a training session at the assembly line of compact car ETIOS at the new plant of Japanese automaker Toyota Motor Corporation in Sorocaba, 100km (62 miles) west of Sao Paulo, in this August 9, 2012 file photo.[Photo/Agencies] |

Don't be surprised if the next time you buy a Japanese product, you discover that instead of "made in China", the label says "made in Thailand" or "made in Indonesia".

Japan is looking to the Association of Southeast Asian Nations as an investment destination for manufacturing due, in large part, to the rising cost of labor in China.

"China is still a big country with huge potential for the Japanese," says Yasuhide Fujii, managing partner at consultancy KPMG's Myanmar office.

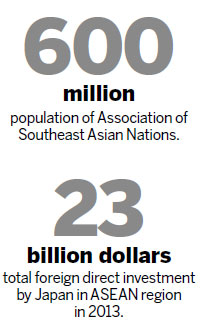

But ASEAN's population of around 600 million means that Japanese investors are looking at the combined market in a similar way to how they view China, Fujii says.

According to ASEAN statistics on foreign direct investment, Japan invested about $23 billion in the region in 2013, accounting for 19 percent of total FDI among the 10 member economies. Japan was the second-largest source of FDI after the European Union, which invested about $27 billion. In comparison, Japan only invested $9 billion in China in 2013, a 32.5 percent drop compared with 2012.

"The cost of labor in China is getting higher," says Fujii, adding that in order to expand manufacturing facilities, Japanese firms are "looking at the lower cost areas like Vietnam, Cambodia and Myanmar".

Stephen Patrick, vice-president of equity research company Ji Asia, says that rising labor costs in China have been a talking point for the past few years.

"Basically, the savings China had for the differentiation of labor costs versus some of the ASEAN countries have closed," he says.

Japanese companies are not the only ones dealing with higher labor costs in China. Chinese companies are spending more on factory automation or robots as a long-term solution to both labor market instability and rising costs.

Patrick says that territorial issues are also a factor to be considered in this investment shift. In September 2012, demonstrations in China followed Japan's attempt to take control of China's Diaoyu Islands.

"The protests that happened in China were more of a catalyst for speeding up this process that was already in place," says Patrick. "But there were protests and damage to Japanese retail and production facilities ... that probably encourage Japanese companies to hedge themselves a bit more."

ASEAN may be attracting more total investment from Japan, but in terms of individual countries, China is still Japan's number one recipient of outward FDI in Asia, so the shift, although significant, is a strategic rebalancing rather than a withdrawal.

"The Japanese are not going to pull out of China," Patrick says. "Larger increases in production facilities will be made in ASEAN countries as opposed to enhancing the same in China."

The geographical proximity of ASEAN countries and significant supply chain infrastructure in countries like Thailand and Vietnam make ASEAN countries attractive choices for Japanese companies.

"The whole supply chain is much easier to manage when the production facility is closer in a geographic area," says Patrick.

Another aspect of the ongoing investment shift is that Japanese companies are hoping to increase their market share in ASEAN countries, which in general have rising disposable incomes and young population.

|

|

| Infographics: Ties that bind China-Japan trade |

|