World Bank sees 2013 China growth of 7.7%

Developing countries on track for 'new normal' of muted economic expansion, global lender warns

Despite receding risks from advanced economies, global growth is likely to be "muted" for the next few years as expansion in China and other developing countries slows, the World Bank forecasts in a new report.

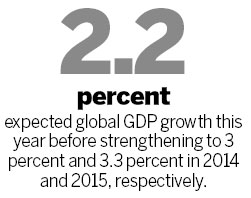

Global GDP is expected to grow by 2.2 percent this year before strengthening to 3 percent and 3.3 percent in 2014 and 2015, respectively, the lending institution said in its semiannual Global Economic Prospects report, published on Wednesday.

In developing countries, GDP growth for 2013 is projected to be 5.1 percent before reaching 5.6 percent and 5.7 percent over the following two years. In China, where the government's target of 7.5 percent for 2013 was buoyed by first-quarter growth of 7.7 percent, the slower pace compared with previous years is due to the country's shift to a consumer demand-driven economy, the World Bank said.

The report predicted Chinese growth this year will be 7.7 percent, slightly higher than the official estimate, followed by 8 percent and 7.9 percent in 2014 and 2015.

Broken down by region, the report predicts growth this year in East Asia and the Pacific of 7.3 percent (5.7 percent if China is excluded); Europe and Central Asia, 2.8 percent; Latin America and the Caribbean, 3.3 percent; the Middle East and North Africa, 2.5 percent; South Asia, 5.2 percent; and sub-Saharan Africa, 4.9 percent.

In both 2014 and 2015, East Asia-Pacific growth should reach 7.5 percent, but risks cited by the bank include gradual reduction in investment from China; Japan's policy of buying up its own debt to keep interest rates low, known as quantitative easing; and fast-rising credit levels and asset prices.

Beyond China, growth in major developing countries such as Brazil, Russia, India, South Africa and Turkey is being held back by supply chain "bottlenecks" that limit productivity gains, according to the report. Internal constraints have replaced the risks these "middle-income" nations previously faced from advanced economies - namely debt crises in Europe and the United States' pullback in January from what would have been a series of forced tax increases and budget cuts known as the fiscal cliff.

Although the developing world's growth will likely outpace that of higher-income countries, "it is significantly slower than what we've been accustomed to in the pre-crisis period (before 2008), but we see this slower growth - still robust, still strong - as something of a new normal for developing countries", said Andrew Burns, global macroeconomics manager at the World Bank and lead author of the report.

Some countries in the eurozone have sunk into recession while the US remains mired in a slow recovery with weak job creation, but external threats lie elsewhere, Burns said. Developing nations could be hurt by inflation driven by the continued loose-money policies of developed countries' central banks, or higher interest rates if the US Federal Reserve changes course and tapers its quantitative-easing program of buying Treasury bonds and mortgage-backed securities.

"We think developing countries are going to be robust (in facing) these changes," he said, "but nevertheless they are a cause for concern, and we think that policymakers need to start to shift their focus from the external world more to their domestic preparedness for these more difficult situations going forward."

World Bank President Jim Yong Kim told the Wall Street Journal that the lending institution is closely monitoring possible "spillover effects" from central banks' curtailing of policies intended to stimulate domestic consumption.

"One of the concerns is what's going to happen if there's a sudden stop to the loose monetary policy (and) what's going to happen to access to capital (for) developing countries," Kim said.

To combat these pressures, the new World Bank report recommends that most developing countries carry through on structural reforms to boost the supply side of their economies, by reducing the cost of doing business, increasing their openness to foreign trade and investment, and investing in infrastructure and workforce development.

"These measures underpinned strong developing-country growth over the past 20 years and are worth sticking with," Burns said.

Developing countries, including resource-rich China, will also be hurt if commodity prices continue to decline, the latest Global Economic Prospects report said. Although increased demand around the world will push up prices of metals, minerals and other raw materials, the effects are likely to be limited. Trade is expected to expand by just 4 percent in 2013, well off the pre-crisis pace of 7.3 percent, according to the World Bank, adding that the value of trade is forecast to expand even less quickly than its volume.

"The coming on stream of new mines and energy sources is putting downward pressure on most industrial commodity prices. If commodity prices were to decline even faster than expected, commodity-exporting developing countries could experience serious fiscal setbacks and weaker growth," said Hans Timmer, director of the bank's Development Prospects Group.

Resilience in international trade, despite weakness in high-income economies, has been fueled by developing countries. Over 50 percent of developing country exports now go to other developing countries, the report said. Even when excluding China, the world's second-biggest economy, so-called South-South trade has been growing at an average rate of 17.5 percent a year over the past decade, in both manufacturing and commodities.