Real estate continues its climb

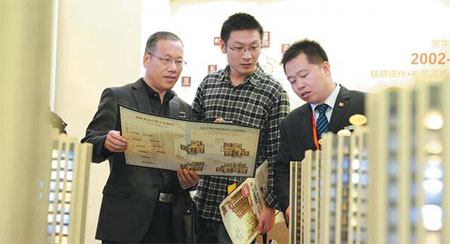

Property prices rise, despite new curbs on the housing market, report He Na and Peng Yining in Beijing.

In March, the government rolled out measures designed to cool China's red-hot property market by reining in speculative investment. One of the measures, a 20 percent tax on capital gains from property sales, triggered widespread panic among potential buyers and sellers.

Following a month of heated debate, speculation, anger, expectation and concern from potential homebuyers and sellers, many cities, including municipalities such as Beijing, Shanghai and Chongqing, have recently unveiled detailed plans to implement the guidelines in their own way. More governments are expected to follow suit.

Some of the measures, especially a ban on single adults purchasing second homes in Beijing, are considered the harshest imposed in recent years.

The average price of newly built apartments in 100 Chinese cities hit 10,098 yuan ($1,640) per square meter in April, rising 1 percent from the previous month. Prices have risen for 11 consecutive months since June, according to a report from the China Index Academy.

The policies have pushed many Chinese investors to buy homes overseas. In February, SouFun International, a real estate and home furnishing network platform, published a survey carried out among its members who want to buy houses abroad.

More than 60 percent of those surveyed set their budget for overseas homes at more than $500,000. The favored countries include the United States, Australia, Canada, New Zealand and Malaysia. The top three reasons for buying property overseas were immigration (44 percent), children's education (25 percent) and investment (23 percent).

To learn more about how Chinese are affected by real estate control policies, our reporters interviewed five residents in and around Beijing. Here are their stories.