Tightened policies on government spending for luxury goods in China have put a temporary cap on the buying of luxury goods as gifts, which has contributed to the slowest annual growth of the market in five years.

That's according to the findings of the latest Bain & Co report released on Wednesday. The consultancy predicted luxury sales on the Chinese mainland to grow a meager 7 percent this year.

He cited a government regulation, effective from October, forbidding government spending on extravagant items, as well as the social media exposure of a number of government officials with luxury goods brands.

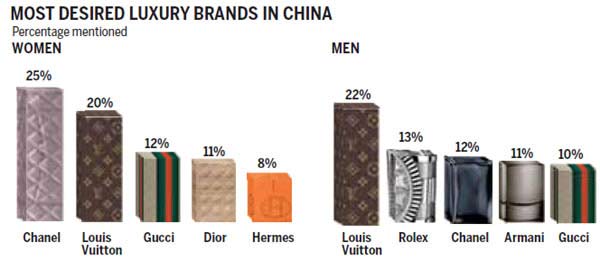

Lannes said products for men will be hardest hit by the changes. "Basically, it's watches and menswear that are most reliant on gift spending."

However, the sector is likely to rebound next year because gifts have been a major feature and tradition of the country's luxury market for years.

Lannes predicted there will be a paradigm shift, and said future gift items will likely have less conspicuous branding.

The luxury market value on the Chinese mainland is expected to hit 113 billion yuan ($18.07 billion) by the end of the year. Watches are expected to be among the hardest hit categories with a 5 percent drop in market value.

However, Chinese purchases worldwide reached 306 billion yuan with spending abroad rocketing by 31 percent.

More than 60 percent of consumption took place in overseas markets, driven by the depreciation of major foreign currencies, and dynamic overseas travel.

As a result, traditional shopping hotspot Hong Kong is losing out to European and US cities, with its growth rate slowing down to around 10 percent.

"More Chinese shoppers have learned to take advantage of the weaker euro and US dollar. For big-ticket items such as watches and jewelry, you can see as much as a 40 percent pricing gap between the euro and the yuan," Lannes said.

Related Stories

Chinese shoppers offer glimmer of hope for gloomy economy

China to become 2nd biggest luxury market by 2017

New generation of luxury brands gets attention

Niche high-end products beat established brands

More young Chinese keen on luxury goods