China will expand a pilot private-placement bond program for small and medium companies.

Information disclosure for initial public offerings will be strengthened and financial access standards for innovation-focused companies will be relaxed.

Jiang Yang, vice-chairman of the securities watchdog, the China Securities Regulatory Commission, said on Saturday that the commission is actively promoting transactions in financial and corporate bonds as well as asset securitization products on inter-bank market and related exchanges, according to commission's website.

He also said more small and medium companies, which have registered in the Third Board, a nationwide over-the-counter market for non-public company shares, will be included into a pilot bond issue program, which will facilitate direct financing.

Jiang said the commission is revising the rules for primary offerings on the growth enterprise market (GEM) board.

The new rules may contain less demanding and more flexible financial access standards for innovation-focused or rapidly growing firms.

The commission also plans to customize a mechanism that can provide small, fast, and flexible refinancing companies publicly traded on the GEM board.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

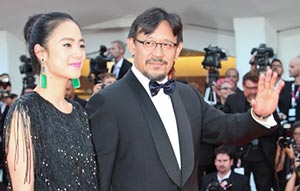

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant