Cypriot parliament rejects levy on bank deposits

|

|

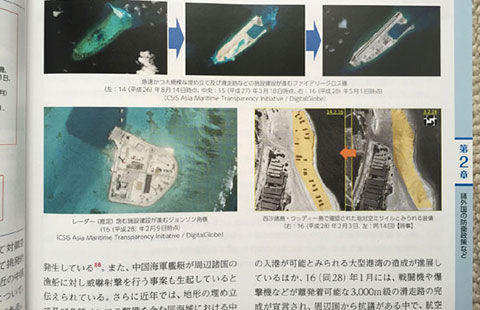

Anti-bailout protesters raise their open palms showing the word "No" after Cyprus's parliament rejected a proposed levy on bank deposits in Nicosia, March 19, 2013. [Photo/Agencies] |

NICOSIA - Cyprus' parliament rejected a Eurogroup imposed haircut on bank deposits on Tuesday, plunging the eastern Mediterranean island into economic uncertainty verging on uncontrolled default.

The 56 member-chamber threw out the levy legislation with 36 against, 19 abstentions and no one in favor.

The levy was decided at the end of last week at a Eurogroup finance ministers meeting in Brussels, after Cyprus President Nicos Anastasiades was warned that emergency liquidity assistance to the Cypriot hard pressed banks would be immediately discontinued.

In a vain effort to build consensus, the government had revised the provisions of the original law so as to spare small savers with up to 20,000 euro ($25,7516) deposits from a 6.75 levy.

It suggested that deposits between 20,000 and 100,000 euros be taxed with 6.75 percent and deposits of over 100,000 euros be slashed by 9.9 percent.

However the measure did not convince opposition parties and even the junior government coalition DIKO party which sided with the opposition in rejecting the bill.

President Anastasiades' own DISY party with 20 seats in parliament abstained when the bill was voted upon. One DISY deputy was absent on a trip abroad.

Parliament's decision was greeted with cries of joy by hundreds of flag-waving demonstrators who had gathered in a nearby square expressing opposition to the deposits levy and urging deputies to reject it.

Demonstrators shouted slogans such as "Cyprus belongs to its people", "Troika get out of Cyprus".

Among the demonstrators were several Spanish and Portuguese who said they shared the Cypriots' opposition to the deposits levy, because they feared that had the bill been passed they would be next in line for a deposits haircut.

During the two-hour debate the leaders of the five parliamentary parties denounced the Eurogroup for trying to impose a humiliating arrangement on one of the smallest EU member countries.

They accused some Eurogroup countries, most notably Germany, of aiming at demolishing the island's economy which is based on the services and banking sectors which cater for several thousand foreign businesses.

Approval of the levy legislation along with another bill increasing the corporate tax from 10 percent to 12.5 percent was a condition for a 10 billion euro bailout by the Eurogroup and the International Monetary fund.

It is unclear how the decision will affect the bailout deal.

There was still no reaction yet by President Anastasiades who has to deal with the prospect of the immediate collapse of the island's second largest lender, Cyprus Popular Bank, and a possible run on the largest lender, Bank of Cyprus.

Cypriot banks are due to reopen on Thursday following a two-day bank holiday decreed by the ministry of finance as a way of preventing a bank run and calming down depositors jitters. No one could still say how depositors will behave in the face of a possible collapse of the banking system.

In a move reflecting anxiety over what could happen next, Britain sent a military plane carrying one million euros in cash to Cyprus on Tuesday for the needs of about 3,500 military personnel serving in two bases on the island in case cash machines and bank cards stop working.

The British defense ministry said it would also give a choice to British servicemen to have their wages deposited in British bank accounts rather than Cypriot banks.