|

|

2009 Global Think Tank Summit > Photo Gallery

|

Little hope of soon replacing greenback(China Daily)

Updated: 2009-07-01 13:55

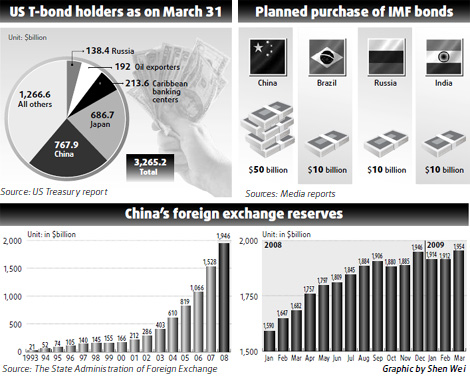

As the US financial crisis continued to send shock waves across the globe, a new international currency regime gained greater credence as an alternative to the current dollar-dominated global monetary system. At the G20 Summit in London two months ago a key question was will the current greenback currency regime, a remnant of the Bretton Woods system, continue as is has in the past. Though many countries had great expectations for the G20 meeting, little substantive progress has been made due to conflicts among different interests groups. First, the US will never voluntarily abdicate the greenback's pre-eminence, as it is a sharp tool for the country to maintain its leading position in the international monetary system. US President Obama publicly refuted China's central bank governor Zhou Xiaochuan's proposal of creating a super sovereign reserve currency to replace the US dollar. Second, European Union member countries see the ongoing financial turmoil as an opportunity to overthrow the greenback, as the euro is today the only candidate currency that could compete with the dollar. European countries, especially France and Germany, hope for reform of the current monetary system that will push the euro's status higher in the international monetary regime. Governor Zhou's proposal of replacing the dollar with an international reserve currency based on the IMF's special drawing rights is not in line with the European Union's interests. Elevating the voice of emerging economies will hinder European hopes as they are second only to the US in the current international monetary framework. With rapid accumulation of foreign reserves, emerging economic powerhouses such as China, Brazil and Russia have drawn great attention from the world, but due to the dollar's reserve currency supremacy and use as a benchmark in commodity prices, they find their economic security increasingly influenced by US Federal Reserve's monetary policies.

Indeed, China is facing a dilemma in its dollar position. As the largest debtor to the US, China wants to see a stable dollar so its massive dollar-denominated assets do not shrink. In addition, China's rapid economic development largely depends on the huge US consumer market, so dollar depreciation threatens the sustainability of export-oriented development. Though the current global financial crisis has its roots deep in the American spendthrift consumption model, emerging markets including China are still pinning their hopes on revival of US consumption to pull their ailing exports out of the mire. After all, it is not an overnight job to establish a social safety net and power up domestic consumption. Due to conflicting interests among diverse economies, radical reform of the current dollar-dominated international monetary system is not likely in the short term, but China should be well prepared for possible changes in the future international monetary landscape. First, it is of great significance for China to change into a more domestic-led development model and never again pursue high economic growth at the expense of environmental deterioration. Second, the country should promote the use of the yuan in international settlement and gradually make it fully convertible. The author is the chief macroeconomic researcher at the SERIChina Economic Research Institute. The opinions expressed in the article are his own.

The first Global Think Tank Summit will be held in Beijing from July 2-4, where close to 100 top-notch think tanks from home and abroad will be represented, including the Brookings Institution.

Main Forum

International Financial and Economic Crisis and Global Economic Outlook International Financial and Economic Crisis and Global Economic OutlookSub-Forums

I: Promoting Trade Liberalization and Investment Facilitation I: Promoting Trade Liberalization and Investment Facilitation II: Sustainable Development and Macro-economic Policies II: Sustainable Development and Macro-economic Policies III: Cooperation and Responsibilities of Multinationals during the Financial and Economic Crisis III: Cooperation and Responsibilities of Multinationals during the Financial and Economic Crisis IV: Global Consumption, Savings and Financial Security IV: Global Consumption, Savings and Financial Security V: Idea Exchange with Global Think Tanks on Key Economic Issues V: Idea Exchange with Global Think Tanks on Key Economic IssuesAgenda

Afternoon of July 2 - Opening Ceremony Afternoon of July 2 - Opening Ceremony July 3 - Main Forum July 3 - Main Forum July 4 - Parallel Sub-Forums July 4 - Parallel Sub-Forums |