|

|

|

Indicators point to China recoveryBy Wang Xu (China Daily)

Updated: 2009-05-05 08:09 The economy is likely to expand 7 percent in the second quarter - up from the first quarter's 6.1 percent - even as it confronts the painful prospect of shedding industrial overcapacity, a top government think tank said Monday. "Economic growth will pick up in the second quarter as the government's stimulus measures gradually take effect," the State Information Center (SIC) forecast. "There has been preliminary success in arresting the economy's downward trend," it said, but did not mention any fallout from the global H1N1 flu alert. But Zhu Baoliang, an SIC economist and one of the authors of the SIC report, said the economy will only be slightly affected by the H1N1 flu. Annualized GDP growth sank to a decade's low in the first quarter, largely because of a collapse in export demand.

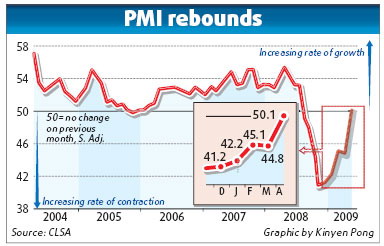

The CLSA China Purchasing Managers Index (PMI), a gauge of manufacturing activity, rose to 50.1 in April, the first time it has been above 50 since last August, CLSA Asia-Pacific Markets said yesterday. A PMI reading above 50 indicates an expansion of the manufacturing sector, while a reading below 50 signals a contraction. Also, the PMI index compiled by the Federation of Logistics and Purchasing rose for the fifth straight month in April to 53.5 percent, up 1.1 percentage points from a month earlier. The positive economic signs sent stock markets up across Asia, with the mainland's Shanghai Composite Index rising 3.3 percent and Hong Kong's Hang Seng index 5.5 percent. "The Chinese government has been extremely successful in stimulating investment," said Eric Fishwick, CLSA head of economic research. "We hope that firmer domestic demand, as government spending gains traction, will keep the PMI above 50 in the months to come." The World Bank said in a report in early April that the Chinese economy is expected to bottom out by the middle of 2009. It also forecast China's economic growth at 6.5 percent for the year. The International Monetary Fund also forecast last month that growth in China is expected to slow to about 6.5 percent this year. Consumer spending held fast over the past months, despite looming unemployment pressure. About 2.68 million vehicles were sold in the first quarter, making the nation the world's largest auto market during the period. Housing sales surged 23.1 percent by value while retail sales rose 15.9 percent in the first quarter, 3.6 percentage points higher than the same period a year earlier.

"Based on the clear uptrend in recent economic activity we believe the worst is already behind China in terms of economic growth," Sun Mingchun, chief China economist of Nomura International, wrote in a research note. Sun said China would achieve its 8 percent growth target this year, with a V-shaped growth trajectory. But some analysts argue that the figures could be volatile and the economy has to deal with the structural problem of overcapacity. "It's still too early to say the economy is experiencing a real recovery," said Zhu, the SIC economist. "Over the past months, local enterprises have been running down their inventories. Now they have to reduce overcapacity."

The first Global Think Tank Summit will be held in Beijing from July 2-4, where close to 100 top-notch think tanks from home and abroad will be represented, including the Brookings Institution.

Main Forum

International Financial and Economic Crisis and Global Economic Outlook International Financial and Economic Crisis and Global Economic OutlookSub-Forums

I: Promoting Trade Liberalization and Investment Facilitation I: Promoting Trade Liberalization and Investment Facilitation II: Sustainable Development and Macro-economic Policies II: Sustainable Development and Macro-economic Policies III: Cooperation and Responsibilities of Multinationals during the Financial and Economic Crisis III: Cooperation and Responsibilities of Multinationals during the Financial and Economic Crisis IV: Global Consumption, Savings and Financial Security IV: Global Consumption, Savings and Financial Security V: Idea Exchange with Global Think Tanks on Key Economic Issues V: Idea Exchange with Global Think Tanks on Key Economic IssuesAgenda

Afternoon of July 2 - Opening Ceremony Afternoon of July 2 - Opening Ceremony July 3 - Main Forum July 3 - Main Forum July 4 - Parallel Sub-Forums July 4 - Parallel Sub-Forums |

|||||