Glut of ways to pay

|

|

China's major e-commerce player JD.com Inc promotes its online investment products during an event in Nanjing, Jiangsu province. [Photo provided to China Daily] |

E-commerce is delivering myriad new options for payment and credit, shaking up the traditional credit-card industry and making it easier both for companies to assess risk and to provide credit for less-established customers

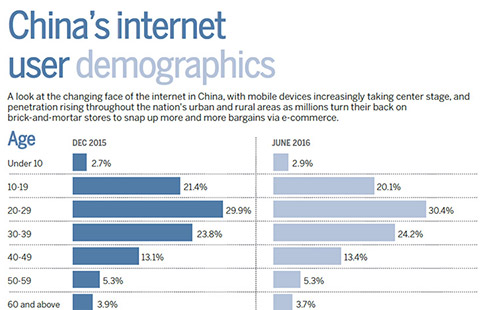

Consumer credit products are becoming increasingly popular among young Chinese, taking a large market share away from credit cards, as competition in the payment industry grows more intense.

JD.com Inc, a major Chinese e-commerce player, recently launched a personal consumer credit service called Baitiao with a maximum credit line of 15,000 yuan ($2,187). It allows the client to buy products first and then choose between delaying payments for up to 30 days and repaying in installments.

Risk assessment is made on all clients based on a wide range of information, including their logins on JD.com, online shopping habits and changes of address, said Xu Ling, vice-president of JD Finance, the consumer finance subsidiary of JD.com.

"We collect information mostly through automation, relying neither on the client for information submission nor on manual investigation," he said. This is unlike commercial banks that collect information on the clients by asking them to provide employment and income certificates, as well as property and car ownership certificates.

Then, JD Finance launched a specialized Baitiao service targeting college students with lower credit lines. This kind of product fills the demand-supply gap left by commercial banks, which either stopped issuing credit cards to college students or raised the threshold of credit-card application for students in the last few years due to higher default risks among the group.

|

|

A visitor reviews a variety of consumer credit products during an e-commerce expo in Beijing. [Photo provided to China Daily] |

The rapid growth of consumer credit has greatly affected the traditional credit-card business. Statistics from the People's Bank of China, the central bank, reveal that China issued a total of 432 million credit cards by the end of 2015, falling 5.05 percent from the previous year. It was the first drop in credit card issuance since 2008.

A banker at the credit card center of a national joint-equity commercial bank, who declined to be named, said: "We have felt rising pressure from large internet companies since they began to offer their own payment services."

Ant Check Later, a consumer credit product launched by the financial arm of Chinese e-commerce giant Alibaba Group Holding Ltd, has different lines of credit ranging from 500 yuan to 50,000 yuan with an interest-free period of up to 41 days.

The clients may choose to make payments through an installment plan at three-month, six-month, nine-month or 12-month intervals at an interest rate varying from 2.5 percent to 8.8 percent.

The product covers a fairly large number of consumers who were not reached by traditional financial institutions. More than 60 percent of its clients had never used credit cards before.

Compared to credit cards, Ant Check Later is more attractive to younger people. About 48 percent of its clients were born in the 1980s and 33 percent in the 1990s, according to data it released in November 2015.

GEO Technologies Ltd, a Beijing-based big data solution provider, said in a report in June: "Consumer financial products like Ant Check Later have vitality. They are well-received by a wide range of clients because they offer a small amount of credit to grass-root consumers on an unsecured basis."

E-commerce giants have unique advantages in consumer finance because they have accumulated a large number of active users and have created a vast layout in various service scenarios. They also own tons of transaction data. This leads to more accurate client-risk assessments at lower costs, the report said.

Analysts expect that consumer finance will integrate deeply with the internet, from products and services to risk management.

An earlier GEO report found that during the first quarter of 2016, nearly 47 percent of an effective sample of more than 5 million credit-card holders also used Alipay, a third-party online payment platform launched by Alibaba. It revealed a clear trend of integration of mobile internet and finance, which has driven the launch of cloud-based payment solutions by major commercial lenders.

Ling Huanian, from the credit-card center of China Guangfa Bank Co Ltd, said that competition from internet companies is forcing the traditional credit card sector to innovate by adopting identification technologies to reduce processing time for card issuance.

Currently, several banks including China Guangfa Bank, China CITIC Bank Corp Ltd and China Everbright Bank Co Ltd have launched instant online card-issuing services. Commercial banks are also using mobile phones and hand-held personal computers to acquire customers online and improve the efficiency of the credit-card application process.

The credit-card sector is putting a greater emphasis on quality rather than sheer numbers, Ling says.

Major commercial banks fighting to optimize the customer experience and increase customer loyalty are using new battlegrounds through the establishment of big data platforms, the use of cloud computing, and the introduction of probe technology, he added.