Apart from special authorization, new borrowings can only be used for urban development, public service expenditure and replacement of outstanding debt, and not regular expenditures.

In the meantime, a warning system will be established for bond issuance, and "high-risk regions will not be allowed to take on more debt," Li said.

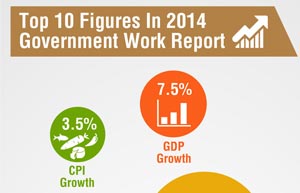

A draft budget by the Finance Ministry showed that 400 billion yuan in local governments bonds will be issued as part of the 1.35 trillion yuan total government budget deficit projected for this year.

With an additional 150 billion yuan deficit, China's deficit-to-GDP ratio will grow to 2.1 percent from 2 percent last year.

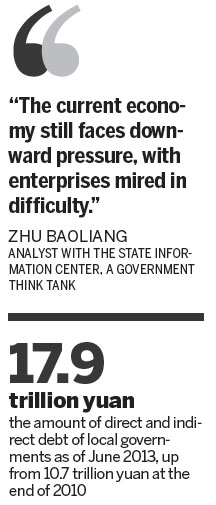

"The current economy still faces downward pressure, with enterprises mired in difficulty," said Zhu Baoliang, an analyst with the State Information Center, a government think tank.

"The country needs a proactive fiscal policy to give it an extra push," he said.

While pressing ahead with tax cuts and higher public spending, the country must keep the deficit rate almost flat in order to guard against risks, Zhu explained.

Bank of America Merrill Lynch Chief China Economist Lu Ting said in a research note that local governments likely will borrow through regulated channels, as the premier promised, to develop a standard local government borrowing mechanism.

"We think some local governments, facing pressure to roll over debt and cut overcapacity, will be active in seeking opportunities to restructure their local SOEs," added Chang Jian, chief economist in China for Barclays Capital.

Xinhua contributed to this story.

|

|

|