|

Investors at a securities brokerage in Beijing. Sectors including culture and media, aerospace, communications and electronics technology led a rally in China's stock markets on Friday. Feng Yongbin / China Daily |

China's stock market rose moderately on its first day of trading after the week-long Lunar New Year holiday, while the global market was turbulent.

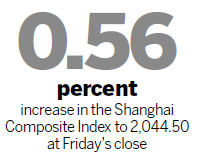

The benchmark Shanghai Composite Index rose by 0.56 percent to 2,044.50 at Friday's close, erasing earlier losses before the Spring Festival. Sectors including culture and media, aerospace, communications and electronics technology led the rally on Friday.

The ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, was up by 2 percent at the close at a historic high of 1,526.

"The stock market experienced big selling pressure prior to the holiday, forcing valuations to relatively low levels," said Zito Ji, an analyst with a mutual fund based in Shanghai. "Meanwhile, there is no major negative news on liquidity or other major aspects. We may see some valuation corrections this month."

Although the HSBC Purchasing Managers' Index for China recorded 49.5 in January - the lowest level in six months - analysts warned that this could be a distortion caused by the Lunar New Year.

"Business and industrial activity may have slowed down, while small enterprises may have sent migrant workers home weeks ahead of the holiday, resulting in much quieter activity in January compared with December 2013 and January 2013. Examining available information, we do not think a notable growth slowdown is evident at present," said a report released by Bank of America Merrill Lynch.

"We maintain our 2014 growth forecast at 7.6 percent and reiterate our view the government will maintain a neutral monetary policy and execute a slightly more proactive fiscal policy in 2014. In the near term, lower inflation could give the central bank more room to ease liquidity and tame interbank rates," it added.