Observers now worry that rising leverage among local governments poses risks to China's banking sector. Moody's Investors Service noted that although bank loans to LGFVs have grown only 19.5 percent since Dec 31, 2010, banks are likely indirectly exposed to relatively opaque non-bank financing structures, such as trust products.

Moreover, banks are investors in bonds issued by LGFVs.

Moody's singled out Bank of Communications Ltd and China CITIC Bank as being more exposed to rising government leverage, because they are big lenders to local governments.

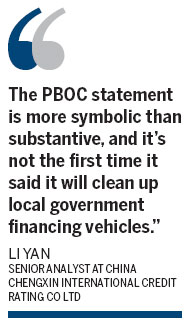

But Li noted that direct loans to LGFVs by banks have already been curbed. Local governments have instead turned to shadow banks, which are lightly regulated and charge far higher rates.

To prevent further local government borrowing from shadow banks, China's regulators have said they'll allow more qualified local governments to go directly to the bond market.

The PBOC's latest statement said it will support LGFVs' moves to obtain finance through "standard market mechanisms" if they are "well-managed, with rigorous internal controls, have a clear function and are financially sustainable".

The PBOC is also "actively" making technical preparations for municipal bond issues. This is the first time that the Chinese government has said clearly that it will develop the nation's municipal bond market.

Traditionally, the Ministry of Finance was responsible for the issue and repayment of local government bonds.

Allowing local governments to issue municipal bonds means they will be directly responsible for their debt, a situation regarded by experts as the most effective way to rein in reckless borrowing.

Municipal bonds and property taxes are two key points of a "new urbanization funding plan" drafted by regulators, which could be released before the Lunar New Year, which starts on Jan 31, Caijing magazine reported. New policy financial institutions could also be set up, it said.