China is 3rd biggest M&A player in Africa

China has become the world's third-largest country doing mergers and acquisitions in Africa, favoring the oil and gas sector, according to a report by international law firm Freshfields Bruckhaus Deringer released on Monday.

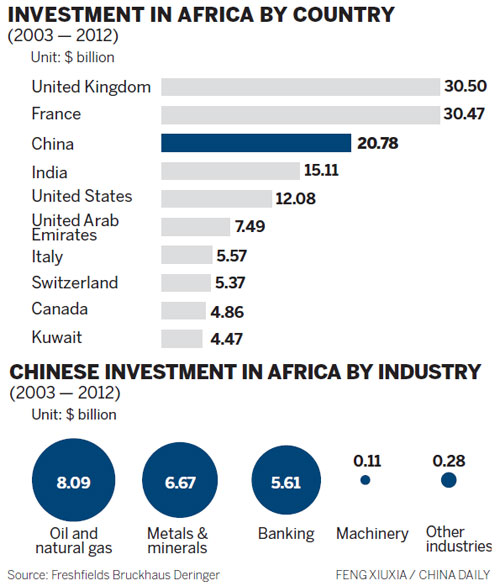

The country made 49 M&A deals totaling $20.8 billion in Africa since 2003, following the United Kingdom with $30.5 billion and France with $30.47 billion.

The value of African inward investment has tripled in the last 10 years reaching more than $182 billion, up 214 percent in 2012 compared with 2003.

"Africa's rapid pace of growth makes it an obvious investment partner for China in many jurisdictions," said Rob Ashworth, Freshfields Asia's managing director.

Chinese dealmakers favor the natural resources sector with $8.1 billion invested in oil and gas across three deals and $6.7 billion invested across 19 deals in metals and mining over the last 10 years, and their preference for these sectors will likely continue, said the report.

Globally, there were 1,190 M&A deals totaling $87.6 billion done in Africa over the same period.

"Extractives and mining opportunities have been big drivers of growth," said Ashworth. "However, consumer-related M&As could take the limelight as GDP per household continues to grow, the middle class in Africa expands and consumer demand rises."

The value of investment targeting these industries has doubled in the last 10 years with $3.8 billion across 71 deals invested in 2012, up from $1.9 billion and 33 deals in 2003.

South Africa, Nigeria and Uganda became attractive destinations for Chinese investors with 23 deals totaling $16.4 billion, said the report.

One of the largest deals was the China-Africa Development Fund's acquisition of a stake in Misr Refrigeration and Air Conditioning Manufacturing Co, a Cairo-based manufacturer of refrigerators and air conditioning systems, from the Barakat Group, for $5.6 billion in 2010.

"The African economy is growing and China's similar development experience makes us believe that Africa is on the right track," said Chi Jianxin, president of the China-Africa Development Fund.

Chi said that Africa is full of opportunities and the African market is increasingly attracting multinational companies from Europe, the United States, Japan and South Korea.

As of this year, over 2,000 Chinese companies have invested in Africa. Apart from the traditional big SOEs - such as PetroChina Co Ltd and Aluminum Corp of China - that are significant investors in the energy and mining sectors, private Chinese companies have in recent years become a key driving force.

Alan Wang, a Freshfields partner based in Beijing and Shanghai, told China Daily that Chinese privately owned companies see great opportunities in Africa given the continent's rising income levels and economic dynamism in recent years, and the high complementary nature of its economy and China's.

Wang said that main challenges to Chinese investors in Africa include lack of understanding of local laws, particularly around labor, environment and taxes; inadequate infrastructure, particularly power supply, transport and logistics; and lack of political stability, as well as bureaucracy and corruption.

"They need to understand the local laws and be prepared to follow them. It is important to study the political environment and not to overly rely on special deals made with particular government officials since they may not hold once there is a change of government," said Wang, adding that companies should also never underestimate startup costs, consider structuring investments in Africa, and find an international partner.

Wang said that as the domestic economy slows, Chinese companies are likely to be driven to focus more on developing overseas markets, particularly in Africa, Southeast Asia and Latin America.

"Over the next few years we expect Chinese investment in Africa to continue to rise. Privately-owned enterprises will lead the way in services and manufacturing, to take advantage of low tariffs that some African nations enjoy when exporting to Western markets as protectionism rises against Chinese exports," said Wang.