Property prices rise in more big cities

Latest figures reveal costs increase for both new and pre-owned homes

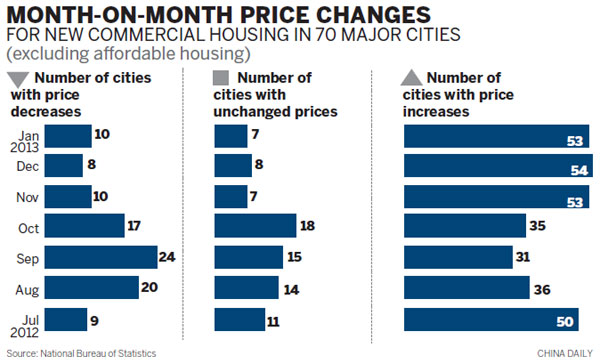

Around three-quarters of China's major cities saw price rises for both new and pre-owned housing in January, figures from the National Bureau of Statistics showed on Friday.

Of the 70 major cities monitored, 53 saw property prices rise year-on-year, compared with 40 in December, according to the NBS.

|

|

A housing project in Qingdao, Shandong province, on Thursday. Despite government measures to cool property market, housing demand still grew steadily in the second half of 2012. [Photo by Huang Xianjie / for China Daily] |

Twenty-five cities in November and 12 in October experienced a price hike on a yearly basis, indicating a rally in the housing market.

The average price growth rate among the cities was 4.7 percent, up from last month's 2.4 percent, the NBS figures showed.

"Despite measures to cool property market speculation, housing demand still grew steadily in the second half of 2012, resulting in a rebound in prices, and this trend is continuing into early 2013," said Mark Budden, area leader, greater China at EC Harris, the global property and construction consulting firm.

Major cities such as Beijing, Shanghai and Guangzhou led the price hikes

Home prices in the capital rose by 3.3 percent year-on-year and 1.6 percent month-on-month, with the equivalent figures in Guangzhou at 2 percent and 4.7 percent, respectively.

However, some second- and third-tier cites, including Nanning and Guilin in Guangxi, Haikou in Hainan, and Dali in Yunnan experienced both yearly and monthly price drops, reflecting a huge increase in property supply in those places.

Industry experts said they expected such varied market conditions to persist over the rest of the year, and attention should be given to potential property bubbles developing in smaller cities.

"There is still strong demand in Beijing, as seen by the recovery led by the market for older homes," said Nie Meisheng, honorable chairman of the Chamber of Real Estate Commerce at the All-China Federation of Industry and Commerce.

"But in second- and third-tier cities it could be a different story, especially those already with a large amount of housing stock."

On Wednesday, Premier Wen Jiabao vowed to keep property price controls in place — such as curbs on the purchase of residential housing for investment purposes, and by expanding the scope of a trial property tax — indicating a determination by the government to control prices.

Further detailed measures, industry experts said, may be needed depending on how the market develops.

|

Media reports suggested that down payments for second-home purchasers were likely to be increased to 70 percent from 60 percent, and the mortgage rate could be hiked to 1.3 times the benchmark interest rate instead of the current 1.1 times.

"We think some targeted measures could be implemented as early as April 2013 for a few large cities if sales and prices continue to rise rapidly," added Wang Tao, an economist with UBS, a view shared by Budden from EC Harris.

"Because of the upcoming two sessions of the top legislature and advisory body in March, the market is still cautious as investors are expecting possible repressive measures to be introduced," he said.

"Historically, we have seen price drops after these meetings, when new regulations or policies have been introduced."

New controls and regulations put in place by the government in 2012 initially led to property price falls, quickly followed by a swift recovery.

"This suggests that consumers can adapt to new policies and integrate them into their investment strategies," added Budden.

"Home ownership continues to be the most understood and tangible form of investment for the Chinese middle class."

Yao Wei, a China economist with Societe Generale SA, said stubborn housing inflation risks and sooner-than-anticipated monetary policy tightening were factors of more serious concern to the economy, especially the domestic equity market.

Contact the writer at huyuanyuan@chinadaily.com.cn