|

|

An A320 flight of China Southern Airlines arrives at Shenyang, capital of Liaoning province. China Southern saw its ASM climb year-on-year by 30 percent in 2015.[Provided to China Daily] |

China's three main airline groups saw declining yields on international routes last year, despite rosy annual performance reports amid record-low oil prices.

The aggressive expansion of capacity on overseas markets and rising competition on routes to regions such as Japan, South Korea and Southeast Asia have resulted in sharp decline in their yields.

The airlines kept setting up new international routes in 2015 and they had been laying out their latest aircraft on those routes. All three carriers have witnessed a jump on their available seat miles (ASM) on international routes, which measures a flight's passenger-carrying capacity.

Last year, China Southern Airlines saw its ASM climb by 30 percent over the previous year. China Eastern Airlines and Air China each had its ASM grow by nearly 25 percent and 20 percent year-on-year, according to their latest earnings reports.

But they saw declining yields, or passenger revenue per available seat mile, on the international routes. Air China, China Eastern and China Southern, each had its yields declined by 19 percent, 4.7 percent and 10.3 percent year-on-year, respectively.

Li Xiaojin, a professor at Civil Aviation University, said: "Currently, the supply of domestic air routes exceeded the demand, due to the growth of high-speed trains. Airlines can only expand their international air routes, as a result of the growing demand for overseas traveling and the frequent flow of domestic and foreign personnel."

Xiong Xing, director of airline ticket business at Ctrip.com International Inc, the largest online travel agency in China, said: "Compared with some well-known foreign airlines, domestic airlines have a weak branding impact on the international market. The competition on international air routes is intense.

"Most State-owned and private domestic airlines added passenger capacities on international air routes. They also introduced low air ticket prices, especially for those long routes from China to the United States and Europe, to attract more customers," Xiong said.

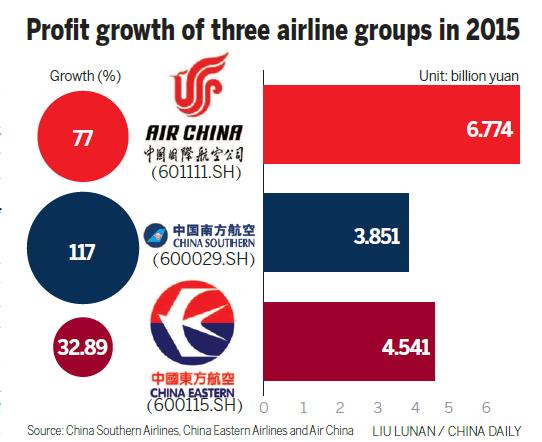

The three airlines reported their best performance in three years thanks to record-low oil prices. China Southern's profit more than doubled to reach 3.85 billion yuan ($595 million) last year, while China Eastern's profit grew 33 percent to 4.54 billion yuan and Air China's profit surged 77 percent to 6.77 billion yuan.

The growth in carrying capacity has prompted a revenue increase for the major airlines. Last year, the three airlines saw their revenues from international air routes added by more than 10 percent year-on-year.

The three State-owned airlines also face growing competition from smaller rivals as they rush to launch more international routes to meet growing travel demand. The number of China's outbound travelers surged 12 percent last year and the World Travel Organization expects that China will continue to be the world's largest source of outbound travel in 2016.

Hainan Airlines launched 12 new international routes last year, with eight being intercontinental routes. Smaller companies, including Sichuan Airlines and Xiamen Airlines, have also started intercontinental routes.

"Chinese consumers have started to care more about services, branding and comfort of airlines, in addition to air ticket prices. Domestic airlines need to consider about their marketing strategies and international branding to meet the new demand," Xiong said.