China's growth vs US crisis

Before and after last weekend's annual World Bank/IMF meeting, financial leaders from across the globe presented their views on the world economy at Harvard University. What did their views have in common? And what do they imply for China?

All the financial leaders voiced concern over the failure to lift the debt ceiling of the United States and the partial government shutdown. Pierre Moscovici, the French minister of economy and finance, said he cannot sign important agreements in Washington because the furlough prevents "non-essential" federal government employees from doing their jobs.

Joaquin Almunia, vice-president of the European Commission and European commissioner for competition, said the partial shutdown has stalled crucial US-European Union negotiations on a trade and investment agreement intended to bolster growth. But he was optimistic that the difficult negotiations would eventually be completed and an agreement reached.

A free trade zone between the US and the EU would send a message to other parts of the world, including China, to proceed with regional free trade agreements. According to Prasarn Trairatvorakul, governor of Bank of Thailand, it could provide further impetus to ASEAN to reach a free trade agreement, proposed to take effect in 2015. ASEAN member states not prepared to be part of the agreement could initially opt out and join later, he said.

Noting that the US dollar is the world's reserve currency, Trairatvorakul urged the US to act more responsibly, saying that a potential default on its payments was not just the US government's problem. He suggested that the US follow the policies that the IMF prescribed to many Asian economies, including Thailand, during the Asian financial crisis in the late 1990s.

Regardless of the problems the US faces today, Trairatvorakul said he does not foresee another currency, such as the euro or the renminbi, replacing the US dollar as the world reserve standard in the coming years.

Moscovici expressed displeasure that only three paragraphs in a recent 600-page document on the US' future outlook were devoted to Europe. But with US policies focusing more inward or looking elsewhere internationally, Europe may present additional lucrative growth opportunities for Chinese companies.

The speakers at Harvard agreed that the worst of the European economic crisis is over and that many EU member states have reduced their deficits drastically in the past three years. But Mario Draghi, president of the European Central Bank, warned that a system in which some countries, such as Greece and Italy, are permanent debtors and others, like Germany, are permanent creditors is not sustainable.

Nevertheless, he stressed that the EU has created 600,000 more jobs than the US since 1999 and the euro is an irreversible single currency. With Latvia set to become the 18th country to adopt the common currency in January, the eurozone will expand further, he said.

What will be certainly welcomed by Chinese investors is Moscovici's policy of according "top priority" to economic growth. Also welcomed will be Almunia's advice to European economies not to unnecessarily favor their domestic companies over their Chinese counterparts. With governments being notoriously unsuccessful in picking domestic winners, Almunia cautioned against a waste of European taxpayers' money.

Almunia also warned European governments not to conceal subsidies in the guise of "green" environmental and energy policy. The EC vice-president vowed to maintain a level-playing field for domestic and international companies competing in the energy and environmental sectors. He emphasized that the benefits of a strongly enforced competition policy are evident and that the market, not policymakers, must determine success or failure.

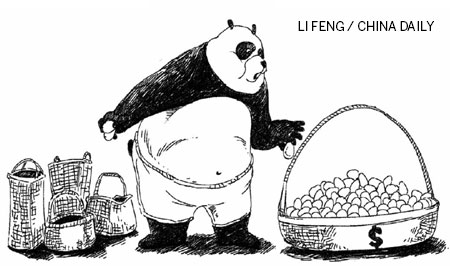

The financial leaders indicated that growth areas outside the US might gain more momentum. With the US still paralyzed by ideology driven bargaining between Democrats and Republicans on how to solve the country's budgetary problems, many Chinese companies may shift their focus on expanding European and regional businesses. The signing of a currency swap agreement last week between China and the EU, as well as recent Chinese negotiations at the East Asia Summit in Brunei may accelerate this process.

The author is a faculty member at the Nottingham University Business School China and a Rajawali Fellow at the Harvard Kennedy School's Ash Center.

- Growth boost tipped for China's switchgear market

- Chinese economy maintains solid growth pace

- China's fiscal reform will boost growth

- Chinese industrial output growth to remain high

- Sipping sector shows moderate growth

- China's growth rate to exceed 7.5%: PBOC official

- China is a major contributor to global growth