|

|

A father and his daughter take part in the riddle-guessing contest at a KFC outlet in Zhengzhou, capital of Henan province, during this year's Lantern Festival. SHA LANG /CHINA DAILY |

Report says the deal could value the company at up to $8 billion

A consortium backed by sovereign fund China Investment Corp has expressed interest in buying a majority stake in Yum Brands Inc's China business, which runs more than 7,100 KFC and Pizza Hut eateries across the country, Bloomberg reported on Tuesday.

KKR & Co, a firm reported to be in the consortium, said in an e-mail to China Daily that it was "unable to comment on market speculation".

The investor group, which also includes Baring Private Equity Asia, is conducting due diligence on the unit, the report said. A deal could value Yum China at $7 billion to $8 billion, Bloomberg quoted unnamed sources as saying.

Yum told China Daily: "We continue to make good progress since we announced the transaction separating Yum and Yum China into two powerful, independent, focused growth companies. We will provide updates on the transaction at appropriate times and we won't comment on rumors or speculation."

A majority purchase by the CIC consortium would give a domestic entity control of a leading fast-food chain in the Chinese market for the first time. Such a deal would also provide the Louisville, Kentucky-based Yum with cash that could be used to fund a dividend and its planned share buyback, as well as help reduce exposure to a business with shrinking market share.

The China-backed investor group is interested in buying as much as 100 percent of Yum China. Yum is considering all options, though it may still decide to pursue the sale of a minority stake or proceed with a previously announced tax-free spinoff of the business, according to sources familiar with the matter.

The company isn't currently running a formal sale process.

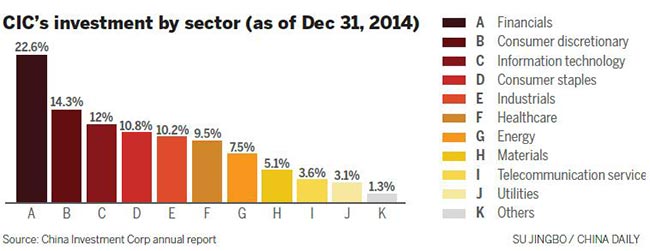

Jason Yu, general manager of Kantar Worldpanel China, said for CIC, it can benefit from the scale and presence of Yum in China to extract more value by reviewing the costs and identify key value drivers or restructuring the business. This will deliver longer-term return for the sovereign wealth fund, Yu said.

"I believe they can still extract value from a troubled business unit. If they can help them reset the business strategy, focus and portfolio, they can benefit from the recovery."

He said Yum can gain from the financial resources provided by CIC and other private equity companies to upgrade their stores and innovate their offers as well as expand their portfolios to more cities in China.

"The cash support will provide much needed resources while they don't have compromise on short-term investor pressure," said Yu.

Yum bowed to activist-investor pressure in October and agreed to separate its China business from its US operations. Hedge fund manager Keith Meister, a protege of billionaire Carl Icahn, said Yum's Asian market could be better served with a more focused business.

China accounted for about 53 percent of Yum's revenue last year, data compiled by Bloomberg show. Yum's China division contributed 57 percent of the company's overall revenue and 54 percent of its operating profit in the latest quarter.

Despite its leading position, Yum has seen its market share continuously drop from 39.8 percent in 2012 to 32.7 in 2013, 28.3 in 2014 and 23.9 percent in 2015.

The second-largest fast-food chain in China, McDonald's Corp, has seen its shares decline from 14.9 percent in 2012 to 13.8 percent in 2015. Ting Hsin International Group is in the third place, according to Euromonitor International.

Last month, McDonald's China announced it was on the lookout for strategic investment partners in the mainland to help it open another 1,000 restaurants by 2020. The Chinese mainland is the company's third-largest market after the United States and Japan.

Bloomberg contributed to this story