BEIJING -- China's consumer inflation rate remained at its lowest level since January 2010, while factories' wholesale prices contracted for a 32nd straight month, official data for October showed.

The latest retail and wholesale consumption figures suggested weak domestic demand, falling commodity prices, subdued manufacturing activity and lingering overcapacity in the Chinese economy, analysts said.

CPI inflation eases

China's consumer price index (CPI), a main gauge of inflation, grew 1.6 percent year on year in October, the National Bureau of Statistics (NBS) said in a statement on Monday.

The inflation index was in line with the consensus projection, and was the same as that of September, which was the lowest since January 2010.

On a monthly basis, the October inflation index was flat against the previous month, compared with September's 0.5-percent increase, NBS data showed.

For the first 10 months, inflation grew 2.1 percent year on year, well below the 3.5-percent full-year target set by the government.

Yu Qiumei, a senior NBS statistician, said higher food prices were the main contributor to CPI growth last month.

Food prices, which account for about one-third of the weighting in the CPI calculation, rose 2.5 percent from a year ago in October, lifting the CPI by 0.83 percentage points.

In the food category, the price of fresh fruit surged 15.2 percent, increasing the CPI by 0.3 percentage points. The price of eggs soared 16.4 percent, contributing 0.14 percentage points to the CPI.

The food inflation was offset by easing non-food inflation, which edged up 1.2 percent year on year in October. Subdued non-food inflation mainly came from falling fuel prices.

Last month, the price of gasoline and diesel dropped 5.6 percent and 7.8 percent year on year, respectively, as a result of China's cuts in the retail price of gasoline and diesel amid falling global commodity prices, Yu said.

Month-on-month growth in transportation and communication prices was significantly weaker than the historical average, as falling oil prices drove down transportation prices, said Bob Liu, analyst at the China International Capital Corp (CICC).

As the effect of falling oil prices is felt to a greater extent, CPI will face more downward pressure, Liu said.

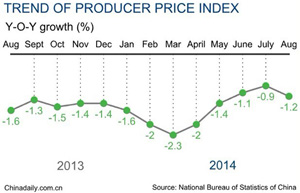

Worrisome PPI

The producer price index (PPI), which measures inflation at the wholesale level, dropped more than expected by 2.2 percent year on year last month, NBS data showed.

The PPI declined for the 32nd straight month and at a faster pace than the previous month. On a monthly basis, the PPI index contracted 0.4 percent from the previous month.

The month-on-month seasonally adjusted annualized PPI index stood at 5.5 percent in October, showing significant PPI deflation pressure, Liu said.

"The deterioration of PPI deflation was mainly attributable to sharply lower oil prices and overcapacity industries," he said.

|

|

|

| China's August PPI down 1.2% | Economists upbeat on China |