|

Rare earth minerals being loaded at Lianyungang harbor, Jiangsu province. In China, which produces more than 90 percent of the world's rare earth metals, industry consolidation is underway. [Photo / Provided to China Daily] |

Rare earth producers nationwide are being encouraged by the government's economic authorities to consolidate into six groups, according to industry leaders.

Chen Zhanheng, deputy secretary-general of the China Rare Earths Industry Association, said the plan, formulated by the Ministry of Industry and Information Technology, has been approved by the State Council.

The six would-be industrial groups are:

The North Rare Earth Group;

China Minmetals Corp;

Aluminum Corp of China;

Ganzhou Rare Earth Group Co Ltd;

China National Nonferrous Metals Industry Guangzhou Corp; and

Xiamen Tungsten Co Ltd.

The North Rare Earth Group mainly comprises Inner Mongolia Baotou Steel Rare-Earth (Group) Hi-Tech Co Ltd.

The six groups are mainly based in major manufacturing areas in Baotou in the Inner Mongolia autonomous region, Ganzhou in Jiangxi province, Guangdong province and Fujian province.

Inner Mongolia Baotou, the country's largest rare earth producer, said on Friday that it has acquired nine rare earth mining companies in the Inner Mongolia autonomous region.

Industry and Information Technology Minister Miao Wei said previously that it is important to avoid consolidations that go against the will enterprises by forcing companies into alliances.

The minister also called for fairness during the process of acquisition and mergers.

China produces more than 90 percent of the world's rare earth metals. The government has said the industry is fragmented and plagued by smuggling.

Rare earths are a group of 17 elements used in a wide range of applications in sectors such as renewable energy, telecommunications and defense.

According to the government, large groups will consolidate the sector's resources and restructure industrial chains. Government policies regarding production quotas and mining permits will favor large groups.

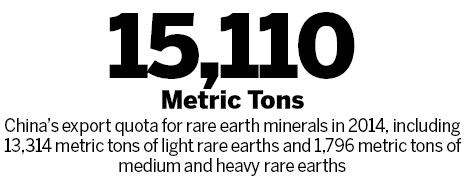

The Ministry of Commerce has released the first batch of export quotas for 2014.

The 2014 export quota of 15,110 metric tons, which is slightly lower than last year, includes 13,314 metric tons of light rare earths and 1,796 metric tons of medium and heavy rare earths.

As of October, Chinese producers had used only 57.8 percent of the 2013 export quota, because of sluggish global demand for the minerals.

Industry experts said the export quota system might be dropped or modified in the future.

Du Shuaibing, an analyst with Baichuan Information, said China might end export quotas on light rare earths but keep those for medium and heavy rare earths, which have smaller production volumes.

He said the opening up of the market will have a positive effect on rare earth pricing in China, where prices have been heavily affected by government policies.

China began to dominate the rare earth trade about two decades ago.

Experts believe China has about 36 percent of the world's reserves.

Because it costs a lot of money to initiate a rare earth mine, China possesses substantial advantages in terms of prices.