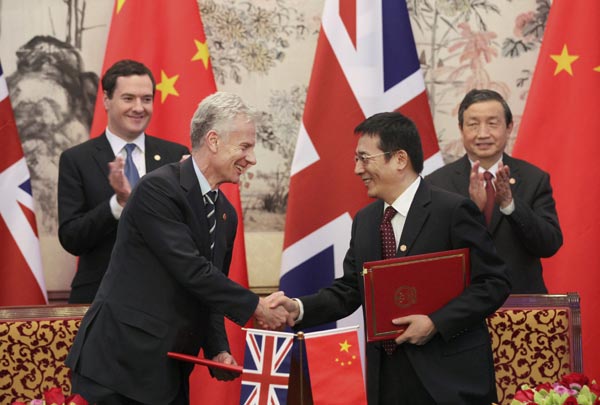

Cooperation projects inked

Agreements with UK to give boost to wider use of yuan in London

|

Vice-Premier Ma Kai (right) and UK Chancellor of the Exchequer George Osborne oversee the signing of an agreement between the two countries in Beijing on Tuesday. The UK is the most popular destination in Europe for Chinese investment. Zou Hong / China Daily |

China and the United Kingdom signed on Tuesday 59 cooperation projects ranging from areas such as infrastructure and civilian nuclear power to yuan internationalization, marking the largest economic cooperation effort by the two countries despite previous political spats.

The deals - signed during UK Chancellor of the Exchequer George Osborne's five-day trip to China - include a memorandum of understanding on civilian nuclear projects and deals to facilitate UK visa applications for staff working on infrastructure-related projects and customs clearance of equipment and materials.

Also, China agreed to grant London an 80 billion yuan ($12.7 billion) initial quota for institutional investors to use yuan to invest in China, giving a further push to the internationalization of the currency.

"I think the 80 billion yuan quota is more than what Osborne had expected," Vice-Minister of Finance Zhu Guangyao said during a media briefing, adding that China would like to harness the UK's experience and expertise in the financial sector to advance the internationalization of the yuan.

The quota will materialize when investors in London apply for licenses to invest yuan directly into China's securities market under the Renminbi Qualified Foreign Institutional Investor, or RQFII, pilot program, Zhu said.

"How the quota will be specifically used will have to go through the Chinese government's approval procedures. We hope that British institutional investors will seize this opportunity," he added.

The move will put London ahead in the race to get a share of the yuan-denominated business, analysts said.