|

|

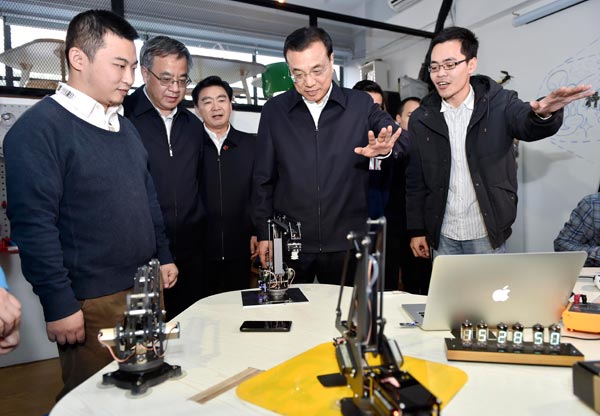

Premier Li Keqiang tried a remote control mechanical arm in Chaihuo Makerspace, an innovation platform in Shenzhen, Guangdong province, on Sunday. LIU ZHEN/CHINA NEWS SERVICE |

Li says govt will offer good environment for sector's growth

Premier Li Keqiang pressed the 'enter' button on a computer on Sunday to finalize the first loan by WeBank, a new online bank and one of five privately funded banks given approval to open in China.

During a visit to China's first Internet-based bank, Li said he placed high hopes on online competition in the banking sector to cut costs and force State-owned financial giants to change outdated business models.

"Internet-based banking is a significant step in China's financial reform," Li said, stressing that the government will provide a good environment for the development of private and online banks.

The loan approved by Li during the bank's soft launch was for 35,000 yuan ($5,600) to Xu Jun, a truck driver in Shenzhen.

According to their agreement, Xu will repay the principal and interest, an annual rate of 7.5 percent, in six months.

Gu Min, chairman of the bank, said the 7.5 percent interest rate is a result of analysis that included the driver's gender, age, education, marital status and social network.

WeBank has recruited about 450 staff members, but more than 60 percent are on the technology side, said Gu. The bank will be based on the Internet and have no physical branches, which can reduce operational costs to 10 percent of the industrial average and cut lending costs.

"The bank will focus on financial services including deposit and loan services to individual consumers as well as micro-sized and small enterprises, rather than chasing big companies and people with high assets," Gu said.