Low productivity gains, returns on investment pose problems, top think tank warns

Despite the slight pickup in economic growth during the second quarter, long-term prospects are not that rosy for China, given the feeble productivity gains and declining returns on investment, the nation's top think tank said on Friday.

The Chinese Academy of Social Sciences said in its quarterly economic analysis that China's potential economic growth rate has fallen to between 6.4 percent to 7.8 percent for the next five years.

Capital efficiency, measured in terms of the GDP to capital stock ratio, posted a steeper decline of 4.9 percent between 2008 to 2012, down from negative 0.9 percent between 1985 and 2007, according to the report.

|

This means that more money has to be spent to generate the same amount of GDP, and this is reflected in the skyrocketing money supply versus slower growth. In 2007, total social financing, the broadest measure of credit supply, was 5.96 trillion yuan ($950 billion), while GDP grew 13 percent that year. During the first half of this year, 10.57 trillion yuan was unleashed, but growth dipped to 7.4 percent.

"The current situation serves as a reminder of how defective and unsustainable our growth model is. There can be no delay in altering the traditional investment- and export-driven model, "said Li Yang, vice-president of the CASS.

The CASS lowered its forecast of China's GDP growth for the whole year to 7.4 percent, from 7.5 percent a few months ago. A day earlier, the International Monetary Fund cut its 2014 forecast for China by 0.2 percentage point to 7.4 percent.

As the economy increasingly relies on credit and investment, technology advances are becoming increasingly irrelevant for growth. Total factor productivity, a measurement of output not generated by traditional inputs of labor and capital, increased 1.4 percent annually during 1990 to 2011, and contributed 11.7 percent of the GDP growth. In western China, the annual gain was 0.8 percent and contributed 6.9 percent to growth.

Zhang Ping, deputy director of the Institute of Economics under the CASS and an author of the report, attributed the slowing TFP gain to several reasons.

He said the services sector, usually with lower productivity than manufacturing, has taken a larger role.

The problem is amplified by the fact that China's services sector is mostly low-end, he said. The modern services, such as education, culture, health, telecommunications and banking, is either heavily subsidized by the government or monopolized, making them less competitive.

An aging population casts further constraints on productivity growth.

The most crucial solution, the report said, is boosting human capital by enhancing education. Even in this field, experts saw no reason for relief as families, especially from rural areas, saw no major benefit from sending their children to college and opted to enter the work force without higher education.

|

|

|

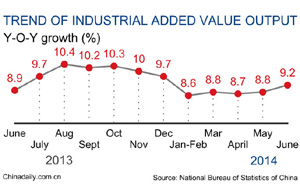

| China's H1 industrial value added up 8.8% | China's H1 retail sales up 12.1% |