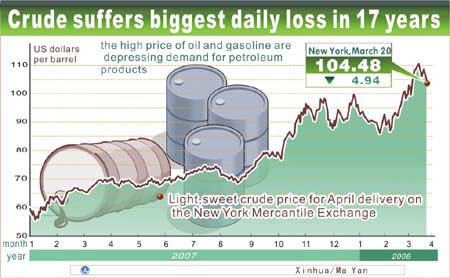

Crude oil takes big dive after US inventories data

(Xinhua)

Updated: 2008-03-20 16:08

Updated: 2008-03-20 16:08

NEW YORK -- Crude oil prices dropped sharply Wednesday after the government released data suggesting that the high price of oil and gasoline are depressing demand for petroleum products.

The steep losses came during a volatile week in commodity and equity markets as dealers weighed signs of recession against aggressive interest rate cuts by the US Federal Reserve to counter the slowdown.

|

|

Light, sweet crude for April delivery declined 4.94 US dollars to settle at 104.48 dollars a barrel on the New York Mercantile Exchange. The April crude contract expired at the end of Wednesday session. The May contract, which is more active, ended down 5.96 dollars at 102.54 dollars.

US crude inventories rose less than expected, up 200,000 barrels to 311.8 million barrels in the week ending March 14, US Energy Information Administration (EIA) reported on Wednesday. The figure was much less than the 2.1 million barrel increase analysts surveyed by Dow Jones Newswires, on average, had expected.

US distillate inventories dropped to their lowest level since June 2005 while gasoline stocks eased slightly below their 15-yearhigh, according to the EIA report.

Analysts said part of the reason for lower inventories of refined products was a reduction in refinery activity because of poor profit margins in the midst of softer demand.

The EIA report showed US demand for gasoline over the past four weeks running 0.1 percent below last year. Demand for distillate fuels like diesel, jet fuel and heating oil lagged by 5.4 percent.

|

||

|

||

|

|

|

|