Microsoft eyes Yahoo to topple Google

Updated: 2008-02-02 17:49

SAN FRANCISCO -- Unable to topple Google Inc. on its own, Microsoft Corp. is trying to force crippled rival Yahoo Inc. into a shotgun marriage, with a wager worth nearly US$42 billion that the two companies together will have a better chance of tackling the Internet search leader.

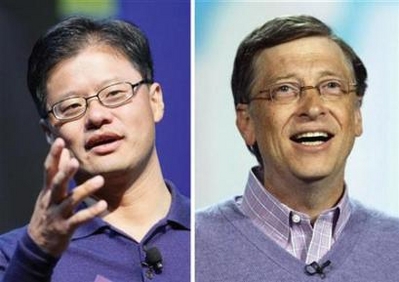

Yahoo CEO Jerry Yang (L) and Microsoft Chairman Bill Gates in a composite image. Microsoft on Friday said it had offered to acquire Yahoo in a proposed cash and stock deal valued at $44.6 billion. [Agencies] |

Microsoft's audacious attempt to buy Yahoo, spelled out in an unsolicited offer announced Friday, shows just how much Google threatens the world's largest software maker's grip on how people interact with computers.

For Yahoo, the bid represents another painful reminder of how missed opportunities and mismanagement combined to open the door for Google to supplant it as the Internet's main gateway, decimating its stock price in the process.

Redmond, Wash.-based Microsoft is trying to avoid a similar fate at Google's hands as more people access services and computer programs online instead of relying on packaged software applications.

Although Microsoft remains the world's most valuable technology company, its position will become more precarious unless it can cultivate a more loyal Internet audience and generate more online ad revenue to subsidize the free services taken for granted on the Internet.

Microsoft is acutely aware of the upheaval that can be caused by a pivotal shift in technology, having been the biggest beneficiary during the 1980s and 1990s of a transition from mainframe computers to personal computers that knocked IBM Corp. off its pedestal.

"Microsoft has to do this deal. It's a battle that Microsoft needs to win," said AMR Research analyst Jonathan Yarmis.

But there's no guarantee that Yahoo will be willing to sell to Microsoft -- or that the deal will win the necessary approvals from antitrust regulators in the United States and Europe if Yahoo capitulates.

Sunnyvale-based Yahoo had little to say Friday beyond a terse statement assuring its shareholders that its board will "carefully and promptly" study the bid.

In a conference call Friday, Microsoft Chief Executive Steve Ballmer indicated he won't take no for an answer after Yahoo rebuffed takeover overtures a year ago.

"This is a decision we have -- and I have -- thought long and hard about," Ballmer said. "We are confident it's the right path for Microsoft and Yahoo."

Yahoo will likely face intense pressure to accept, given its steadily sliding profits and a murky 2008 outlook that caused its stock price to drop to a four-year low earlier this week.

Microsoft's US$31-per-share offer -- originally valued at US$44.6 billion -- represented a 62 percent premium to Yahoo's closing price late Thursday, although it's below Yahoo's 52-week high of US$34.08 reached less than four months ago. On Friday, the total value of the cash-and-stock deal fell to US$41.7 billion, or US$28.95 per share, because Microsoft's shares declined on the news.

Yahoo shares soared to a split-adjusted high of US$118.75 in 2000 before the dot-com bust. That peak coincidentally also was just before Yahoo gave Google its first big break by hiring it to run its search engine.

Search engines are crucial tools because they have become a central hub in hugely profitable ad networks.

Advertisers around the world are expected to double their spending on the Internet during the next three years as more people get their news and entertainment on the Web instead of television, radio, newspapers and magazines. The trend is expected to create an US$80 billion online ad market in 2010, up from an estimated US$40 billion last year.

After realizing how much money Google was making from search, Yahoo introduced its own technology in 2004, but by then it was too little, too late.

|

|

|

||

|

||

|

|

|

|