City builds national financial centre

Chengdu, birthplace of Jiaozi, the world's first paper currency, is looking to build upon its innovative past to become an important financial centre in China.

According to the Sichuan provincial capital's latest development plan, Chengdu expects to become an internationally renowned city with sustainable development by 2050, and financial development is set to play a significant role.

In early February, Chengdu announced the construction of a modern financial industrial cluster to explore fields such as technology, supply chains, green energy and cultural finance. To promote the spirit of innovation and in honor of Jiaozi paper currency culture, the Jiaozi Financial Technology Centre will open in Chengdu in April.

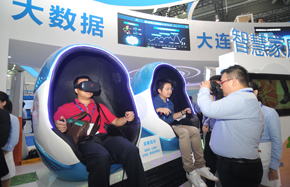

Located in the Chengdu Hi-Tech Industrial Development Zone, the centre, with an area of 10.9 acres, focuses on research and development of financial safety, third-party payment, intelligent investment consultancy and credit investigation based on big data.

It aims to attract large and middle-sized financial technology companies and set up an international financial communication and innovation centre.

The centre will feature some 120 financial technology enterprises, 20 research institutes and threeto- five trading markets.

Additionally, the second phase of Financial Dreamworks Chengdu, a local makerspace for the financial industry, will open in July, to provide some 4,000 desks for 300 innovative entrepreneurial teams.

A museum for Jiaozi, in an area of 1.14 acre, will open to the public this year. It will showcase the development history of the financial industry based on payment. It will also provide insights into the blueprint of financial technology in the future.

The museum is hoped to become an urban financial cultural centre to further encourage sharing and innovation.

XW Bank, established in Chengdu in December 2016, and the first internet bank from the central and western regions of China, has been reported a success.

Jiang Hai, executive director of the board of the bank, said it has established close cooperation with leading domestic companies, including Alipay, a major electronic payment tool, China Mobile, a major telecommunications operator and Didi Chuxing, the country's largest ride-hailing company. Among the bank's 10 million clients, more than 80 per cent are from provinces outside Sichuan.

It has adopted big data, cloud computing, artificial intelligence and deep learning into the bank's credit and loan business.

Chengdu expects to become a financial centre with global influence in 2022 when the added value of the financial industry is set to reach 250 billion yuan (£28.4 billion), according to the local government.

The financial industry contributed 11.6 percent to the city's GDP last year with a financial added value of up to 160.43 billion yuan, official data showed.

|

|

The city's financial district is located in the Chengdu Hi-Tech Industrial Development Zone. provided to China Daily |