Short selling believed to be behind criticism of Hanergy?

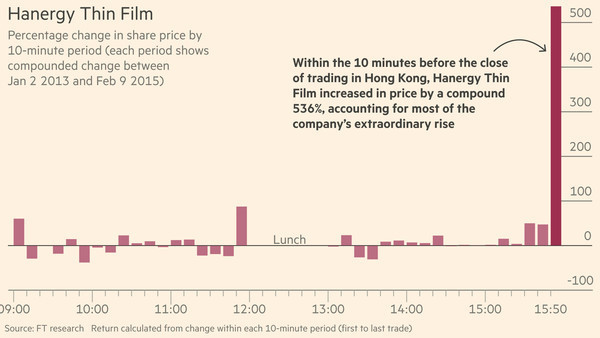

From January 8, 2015, Britain's Financial Times (FT) began publishing a series of articles calling into question the trading price and soundness of Hanergy Thin Film Power Group Ltd.'s Hong Kong-listed stock (Hanergy, stock code 0566.HK). On March 25th the FT published a two-piece article, including an in-depth investigation and an editorial.

The article shows for the past two years, Hanergy Thin Film Power Group shares have soared during a ten minute period from 3:50pm in Hong Kong. An FT analysis of two years of trading data of Hanergy Thin Film stocks — more than 800,000 individual trades on the Hong Kong Stock Exchange — shows that shares consistently surged late in the day, about 10 minutes before the exchange’s close, from the start of 2013 until February this year.

|

|

[Photo/Financial Times] |

Some analysts said they suspected that the hedge fund BHP, representative of short sellers with positions against Hanergy, is behind the FT's reports against the company. Those professed insiders say the purpose is to make up the 3 billion USD in losses that short sellers currently face.

According to mainland media reports, BHP is a hedge fund registered in the Bahamas that was set up by former Lehman Brothers investment bankers Adam Ivory and Scott C. Dorey. Beginning in 2013, BHP took a short position on 1.2 billion Hanergy shares. With a significant rise in stock price since then, it is expected that BHP could suffer a loss of more than $3 billion. In mid-March, Hong Kong Next Magazine reported that a group of hedge-fund managers from the US had flown to Hong Kong to meet with media outlets in an attempt to drum up negative news reports about Hanergy.

Bloomberg data shows that on January 8, the short-selling rate on Hanergy stocks was 0.02 percent. The next day, it was up 1,200 times, reaching 25.5 percent. The short-selling rate of Hanergy stocks increased from 0.76 percent on the 26th Jan to 4.26 percent on the 28th and 16.85 percent on the 29th. The most recent short-selling rate spike against Hanergy happened on March 24 and 25, increasing from 0.84 percent to 13.95 percent and 21.18 percent respectively.

These three instances of soaring short-selling spikes are consistent with the dates that the FT released reports on Hanergy. The FT reports were published on January 8, 2015; January 29, 2015; and March 25, 2015.

Yang Xiangdong, a partner at Beijing Zhong Heng Xin Law Firm, said he believed it would not be a coincidence that the rate of short selling of Hanergy stocks soared while the FT wrote a critical report on Hanergy at the same time.

Yang said if a foreign media company has been consistently writing negatively about a company and putting pressure on the HK’s Securities and Futures Commission, then it's not the investors who benefit, but the hedge funds that are holding short positions.

The main author in the series of FT articles relating to Hanergy was London-based hedge fund correspondent Miles Johnson. Information shows that as of March 25, 2015, Johnson was the main author of a recent 100 articles, 96 of which have focused on hedge funds and the remaining four articles are all reports critical of the Hanergy stock price rise.

Yang, who was previously a media columnist who focused on listed companies, also said that it was unusual for a hedge fund correspondent in London to suddenly write in-depth reports about a solar company listed in Hong Kong.

In response to FT reports, Hanergy issued a voluntary clarification announcement on March 25, saying that the board of directors was not aware of any market misconduct as alleged by the FT. It announced that Hanergy’s controlling shareholder and chairman, Li Hejun, also denied the FT allegations and confirmed that his holdings are all public records and that his trading in Hanergy shares has been properly recorded and disclosed. He also said he has not been involved in any market misconduct or manipulative activities related to Hanegy stocks.

Hanergy said it would retain all legal rights to action against parties who publish or disseminate libelous, untrue, or incorrect information about the company and its shareholders.

Prior to the announcement, Hanergy Thin Film’s controlling shareholder Hanergy Holding Group issued an announcement saying it was not clear why the stock price was so volatile, but looking at the prevailing market conditions, the rise in stock price might be due to the Chinese government’s positive policies concerning environmental protection and new energy, as well as the Shanghai-Hong Kong Stock Connect opening a channel for funds flowing south from the Mainland, breakthroughs in non-related transactions, and several international investment banks issuing bullish research reports.