Logistics property a hot commodity in China

Updated: 2014-06-04 14:32

(China Daily)

|

|||||||||||

|

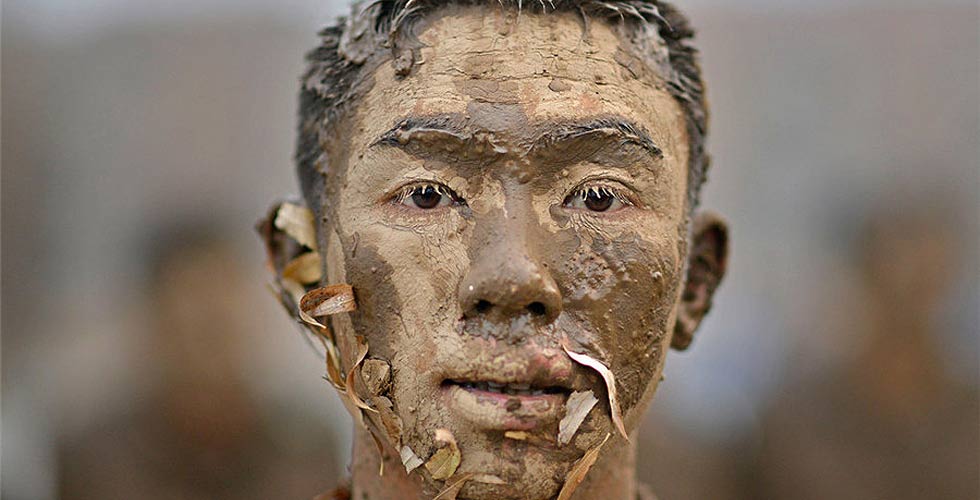

| Container wharves and logistics warehouses at the Yangshan Deepwater Port. Photo bu Gao Erqiang |

Premium returns of high-end logistics facilities have resulted in nearly 4 billion yuan ($641 million) worth of transactions in the sector since 2011 in Shanghai, China’s financial hub, with new capital flowing in constantly, a report from CBRE said.

Investment returns average at 6.7 percent in logistics facilities in Shanghai, the highest in China. With those high returns, Shanghai accounts for 90 percent of the nation’s 4.4 billion yuan prime logistics en-bloc facilities transactions in the period since 2011, the report said.

Imbalanced supply and demand

China’s large logistics market potential stands in stark contrast with its limited supply of facilities. As of 2012, there were a total of 698 million square meters of commercial warehouses, with only a fraction of them meeting the standard of modern logistics facilities, according to the China Association of Warehouses and Storage.

The total modern logistics space in the nation reached 13 million square meters by the end of 2013. Shanghai was able to supply only 5.85 million square meters of industrial land throughout 2013, just half of that in 2011, and the portion for logistics use was even smaller.

Only about three percent of industrial land is used by logistics facilities and that number has been shrinking over the past three years. A total of 600,000 square meters of land was put into logistics use in 2011, 400,000 square meters in 2012 and just 270,000 square meters in 2013.

“The robust demand and a tight supply have pushed up logistics rents across the nation, which recorded growth for the last 18 quarters in a row,” said Frank Chen, head of CBRE China Research.

Chen added: “The logistics sector has attracted great attention from investors, given its attractive yields and solid industry fundamentals. This is particularly true when compared with the already competitive and congested office and retail markets and the highly-regulated residential market with abundant supply.”

Recent market activity

In the first quarter of 2014, non-bonded rental growth declined slightly. Demand for non-bonded warehouses in Shanghai in the first quarter of 2014 remained subdued in comparison to the peaks seen in 2011 and 2012, according to Jones Lang LaSalle, an international real estate advisory company.

Inquiry levels were stable with the previous quarter, but a lack of new completions and the dampening seasonal effect of the Chinese New Year meant that few major leases were signed. Moderate net absorption in the Pudong Airport submarket was balanced out as an e-commerce firm vacated its space in West Shanghai to build its own warehouses.

Overall non-bonded vacancy was flat, rising only 10 basis points to 10.6 percent. The area west of the city’s Huangpu River, Puxi, has lost some of its attractiveness as tenants show increasing willingness to consider cheaper choices in satellite cities like Kunshan in Jiangsu province, which is connected to Shanghai by highway, rail and metro.

The softening demand in Pudong submarkets led to deceleration in non-bonded areas’ rental growth, which edged down from 1.0 percent quarter-on-quarter last quarter to 0.8 percent in the quarter starts in April. Conversely, rental growth in Kunshan continued to perform strongly, rising 3.4 percent quarter-on-quarter, with the best performing projects located close to the Shanghai border.

In the bonded market, vacancy has fallen while rents have risen. Many deals have been under negotiation in the bonded zones since the third quarter of 2013, when the Shanghai pilot Free Trade Zone was officially established.

The improvement in China’s export outlook also generated more interest in the bonded areas. Most of the demand comes from the Yangshan Port Bonded Area in Lingang, where activity has been slow since the financial crisis.

Overall, the vacancy rate of the bonded area declined from 21.2 percent to 14.9 percent in the bonded areas, whilst rents rose 4.2 percent quarter-on-quarter, especially as strong inquiries and rising demand this quarter gave landlords larger pricing power for their remaining space.

Looking ahead

Regarding competition from satellite cities near Shanghai, Jones Lang LaSalle expects rental growth for Shanghai in 2014 will grow at a similar rate as last year’s 4.3 percent.

There are over 460,000 square meters of non-bonded space under construction and scheduled for 2014 completion. Although nearly 60 percent of the new supply is located in the traditionally strong Puxi area, “leasing progress may be slower than usual, as several projects are multi-storey, rather than single-storey, which appeals to a broader range of tenants,” noted Stuart Ross, head of industrial for Jones Lang LaSalle China.

Slow demand may lead to a rise in market vacancy this year. Bonded rental growth should remain strong over 2014, though it could slow if the trade outlook weakens, or if a lack of progress in free trade zone policy curbs demand. There are two pieces of good news for the logistics property market. The municipal government of Shanghai has decided to reduce maximum average industrial land use for a period of 20 years beginning July 1. Additionally, there is a new policy that will make it easier for land previously zoned for industrial use to be rezoned for office and R&D use.

Future growth points

In the future, logistics developers are more likely to sign master agreements with strategically important tenants to provide logistics facilities at the national level, while the increasing difficulty of acquiring land banks in strategic locations is likely to push international logistics developers to ally with large domestic developers or thirdparty logistics providers with better access to industrial land.

At the same time, the increasing market share of large industry players will further drive third-party logistics demand for standard warehouses, said Louisa Lou, head of industrial and logistics services, CBRE China.

Looking ahead, the torrid e-commerce market will also reshape the nation’s logistics market by adding more modern logistics facilities.

China’s e-commerce market will exceed $1 trillion by 2020 and become the largest in the world, according to the Boston Consulting Group.

Hot Topics

Wei Guirong drives his granddaughters from kindergarten on his home-made three-wheeled vehicle in Luorong county, Liuzhou city of Guangxi Zhuang autonomous region, on May 19.

Editor's Picks

|

|

|

|

|

|