Dongfeng jumps into front seat

By Li Fangfang and Li Xiang ( China Daily Africa )

Updated: 2014-02-24

|

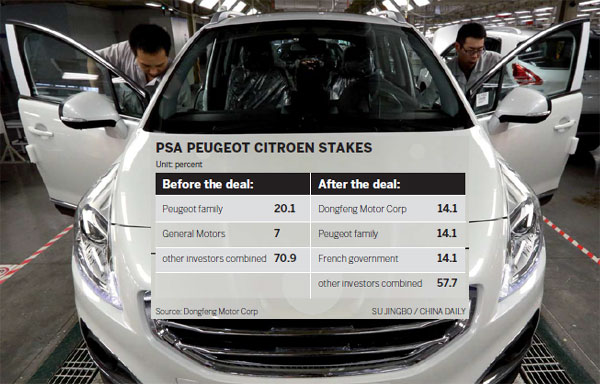

Workers make final inspections of a Peugeot 3008 compact SUV on the production line at a plant operated by Dongfeng Peugeot-Citroen Automobile Ltd in Wuhan, China. Dongfeng is acquiring a 14.1 percent stake in the French automaker for $1.09 billion. Tomohiro Ohsumi / Bloomberg |

Purchase of stake in Peugeot gives it access to new technology and markets

China's second-largest vehicle producer, Dongfeng Motor Corp, has bought a 14.1 percent stake in French automaker PSA Peugeot Citroen for 800 million euros, the largest foreign acquisition by a Chinese state-owned auto company.

According to Dongfeng's statement to the Hong Kong stock exchange on Feb 19, the two parties have signed a memorandum of understanding.

Under the agreement, the Chinese company will subscribe to shares to be issued by Peugeot to increase its capital reserve at 7.5 euros a share, for a total subscription price of 524 million euros.

Dongfeng also agreed to spend another 276 million euros to buy shares pursuant to a Peugeot rights issue.

The French government is also expected to acquire 14.1 percent of Peugeot's shares.

A new committee overseeing development in Asia will be established within the supervisory board of Peugeot, with a representative of Dongfeng to serve as chairman.

The deal ends the Peugeot family's dominance of the company. Dongfeng, the French government and the Peugeot family will each hold the same number of shares and have the same voting rights at the company's general meetings.

Although the capital injections from Dongfeng and France still require approval by regulators in their respective countries, Peugeot said that the agreement will be signed on March 26, and the deal will be concluded before April 30.

Peugeot also announced during a news briefing in Paris on Feb 19 that the company's net loss had narrowed from 5.01 billion euros in 2012 to 2.32 billion euros last year.

"We have gone through some very challenging years for the European automotive industry, which have added to the group's structural difficulties, notably its over-dependence on Europe.

"We vigorously implemented difficult restructuring measures, which are now starting to bear fruit," said Philippe Varin, chairman of the PSA Peugeot Citroen managing board.

"The globalization process is proceeding apace, with in particular an excellent performance in China. With today's announcement, we are giving a new impetus to our group, with an ambitious industrial and commercial plan and solid financial resources."

This year, Peugeot expects growth in automotive demand to be about 2 percent in Europe and about 10 percent in China.

The company aims to increase its production capacity to 750,000 units in China by next year and to double its network of dealers in the Chinese market, Varin says.

"China will be the No 1 market for us in 2015."

A fourth production plant may be built in China to achieve the company's goals in the world's largest and fastest-growing auto market, he says.

He adds that Peugeot will establish an export joint venture with Dongfeng for the sale of its own brands (Peugeot and Citroen) and joint venture brands produced with Dongfeng in key markets in Southeast Asia.

A joint research and development center in China for products and key technologies dedicated to fast-growing markets will be established by Peugeot and Dongfeng.

Peugeot's market share in China stood at 3.6 percent in 2013, according to the company's 2013 annual results.

"We will continue to increase our market share in China through the extension of our product range and the launch of new products," said Jean-Baptiste de Chatillon, chief financial officer of Peugeot, at the news briefing.

The company will launch its new models, the DS5 LS and DS CUV, in China this year.

Analysts say that the alliance will give the French automaker access to cash and the Chinese automaker a path to become an international player.

"PSA and Dongfeng both stand to gain from the deal, with a strategic emphasis on raising sales in emerging markets, while using their production bases in China to offer competitively priced models," says Namrita Chow, a senior analyst with the United States-based consulting firm IHS Automotive.

"For PSA, the benefits of the deal and access to funds are quite straightforward. The automaker will avoid bankruptcy in 2015 following the new capital injection, while the deal with Spanish bank Santander will keep it afloat after its state guarantee expires next year," Chow says.

"The alliance will not only help PSA extend its presence in markets beyond Europe but it will also give Dongfeng greater access to international markets," she says.

"Stagnant and declining markets in Western countries not only helped China overtake the US as the world's largest vehicle market, they also supported improvements in Chinese automakers' capabilities and revenue," says Zhong Shi, an independent auto analyst in Beijing.

"We have seen in recent years that more Chinese automakers are capable of competing with foreign rivals in global markets."

Zhong says these trends will also help the Chinese automotive industry in terms of products.

"Local production will no longer mean the simple transfer of existing models to Chinese plants. New models will be jointly developed by foreign and Chinese car manufacturers," Zhong says.

In the next three years, the partners' 50-50 joint venture, Dongfeng Peugeot Citroen Automobile Co Ltd, aims to ramp up annual production capacity in China to 1 million units. That will support growth in sales in emerging markets in Asia and Africa, starting with Nigeria, using kits from China, according to IHS.

Dongfeng said in its statement that the two parties will "enhance the research and development capabilities of the entire value chain" and strengthen overseas cooperation to achieve the objective of selling 1.5 million vehicles under the Dongfeng, Peugeot SA and Citroen brands each year starting from 2020.

"The change in structure will greatly benefit their Chinese joint venture, as the tighter partnership will increase the efficiency of formulating strategies and bring more resources to Dongfeng Peugeot Citroen," Zhong says.

"Dongfeng can also put the production of its internally developed passenger car models in the joint venture, sharing resources with its French siblings."

Varin said that through the deal, Peugeot and Dongfeng are taking a partnership that's more than 20 years old to the next level in China by implementing a major industrial plan.

He said Dongfeng Peugeot Citroen will launch two to three new models a year globally under the three brands of Peugeot, Citroen and Dongfeng's own brand.

"The acquisition will help Dongfeng promote its brand around the world and reinforce the reputation of China's automobile industry," says Zhang Zhiyong, a Beijing-based auto industry analyst.

He suggests that Dongfeng ask Peugeot to shift its market focus to China "so that Dongfeng may benefit from PSA's technology and product advantages".

Peugeot now makes vehicles in three factories in China, under Dongfeng Peugeot Citroen Automobile Co Ltd, which was established 1992 in Wuhan, Hubei province. Sales by the venture boomed 25 percent last year to 554,457 units.

Dongfeng Motor sold 3.53 million vehicles in China last year, 14.8 percent more than the year before.

In December 2012, Dongfeng agreed with its Japanese partner, Nissan Motor Co Ltd, to locally produce the latter's premium Infiniti vehicles in a plant in Xiangyang, Hubei province, starting this year.

Furthermore, Dongfeng signed a $1.3 billion joint venture agreement with Renault SA in December, the first production facility for the French carmaker in China.

In China, privately owned Zhejiang Geely Holding Group Co Ltd sealed a binding deal in 2010 to buy ailing Swedish luxury car brand Volvo Car Corp from US-based giant Ford Motor Co for $1.8 billion.

Last week, China's largest vehicle parts producer, Wanxiang Group Corp, won the bid for the assets of US-based sports car and electric car maker Fisker Automotive Inc for approximately $149.2 million.

Contact the writers at lixiang@chinadaily.com.cn and lifangfang@chinadaily.com.cn

(China Daily Africa Weekly 02/21/2014 page23)