De-risking China's online lending platforms

Authorities crack down on P2P players to sift out frauds and rein in runaway growth

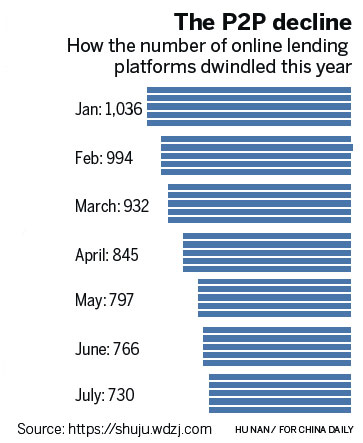

In 2015, the online peer-to-peer or P2P lending sector was booming in China, with over 3,400 platforms vying to offer financing to small businesses and individuals. Now, their number has shrunk drastically to less than 800.

A big question mark hangs over the sector's future like a Damoclean sword. Aggressive expansion and numerous high-profile frauds have prompted an unprecedented regulatory scrutiny and crackdown on the sector.

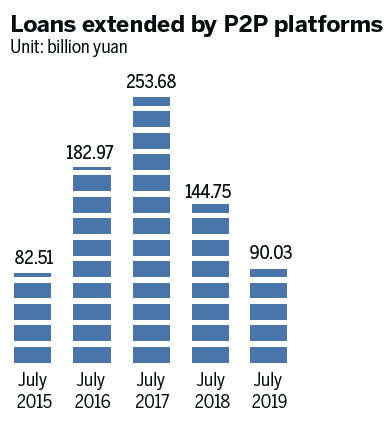

According to estimates by wdzj.com, or the Home of Online Lending, an online lending data provider, transaction value of P2P platforms also declined by more than 62 percent year-on-year to about 90 billion yuan ($12.6 billion) in July. Total outstanding value of loans stood at almost 667 billion yuan, down by 30 percent year-on-year.

The sector suffered a further setback after Lufax, one of China's largest online wealth management platforms, which is backed by financial giant Ping An Insurance, was reported to be planning an exit from the P2P business. The company later said it is shrinking its P2P business - it neither confirmed nor denied the news report.

"Everyone in the industry seems to be anxious at the moment. Each time there is news about a scandal or a business shutdown, it is a blow to investors' confidence. A single case could lead to a chain reaction that causes liquidity risks for platforms including well-established ones," said an executive of an online lending platform who asked not to be identified.

The drastic shrinkage of the online lending business is a result of tightened regulation starting this year as financial authorities, both at national and local levels, ordered P2P lenders to reduce their existing business scale and reduce the number of creditors and borrowers on the platforms. Regulators also required the platforms to connect their real-time operation data with the regulatory system. Those who fail to do so in time will face business shutdown.

The intensified government scrutiny underscored the regulators' concern that the explosive growth of P2P platforms appears to be running out of control and the risks associated with the business could spread to the rest of the country's financial system and threaten the stability of the overall economy.

Ever since the online lending business first emerged in 2007 in China, the sector has been plagued by rule violations, illegal capital pooling and outright fraud. Some of the platforms have turned into Ponzi schemes, which ended with platform owners running away with investors' money. One of the most high-profile scandals included the case of online lender Ezubao, which illegally raised nearly 60 billion yuan from the public and engaged in fake or fictitious investments.

Sector experts said that given the continuous stringent government scrutiny and crackdown, a major sectoral consolidation is on the way and there is likely to be more closures of P2P platforms in the foreseeable future.

"The regulators have issued a series of instructions to consolidate the industry. The trend of decline in the industry in terms of the number of platforms and value of outstanding loans is likely to continue," said Dai Zhifeng, an analyst at Zhongtai Securities.

The country's top banking regulator is still in the process of formulating the regulation to standardize the P2P sector. The much-anticipated registration process, which was seen as the first step in introducing P2P licensing system, has been delayed. So far, no online lending platform is officially registered with the regulator or obtained the P2P business license.

Delays and uncertainty in regulation have prompted many P2P lenders to reconsider their future in the P2P lending business. It also raised questions about the sustainability of the business model.

Some platforms began to see increasing loan defaults amid a slowing economy. Some are struggling to meet the heavy regulatory requirement and they have ceased to offer new products and some are preparing to liquidate their platforms.

Xue Hongyan, who researches internet finance at the Suning Institute of Finance, said that if other major players in the online lending business follow Lufax's suit and downsize their P2P business, it will further weaken investors' confidence in the sector.

Many P2P platforms are now seeking to transform their business model and looking at other areas, including wealth management and consumer lending. Some platforms are seeking partnerships with big financial institutions and hope to serve as "loan-assisting" agencies that help bridge small borrowers with big financial institutions, according to Dai.

"Some platforms are shifting attention from individual investors to financial institutions for source of capital. The 'loan-assisting' model is likely to be the main direction of business transformation for many P2P platforms," he said.

But, one challenge for the P2P platforms that are seeking to enter the consumer lending business is that some may lose their competitive advantage as an intermediary platform, Dai said. An intermediary platform usually does not require a strong capital position.

"In the consumer lending market, they will have to find new competitive advantage with the ability to target the right market and develop compatible risk management models," he said.

Chen Huan, chief risk management officer at Yiren Digital, formerly known as Yirendai, the P2P lending platform of financial technology firm CreditEase, believes that the online lending sector still holds promise as it serves as a crucial financing channel for small businesses and rural borrowers that are often overlooked by large financial institutions.

"Stricter regulation and some market liquidation will be beneficial to the healthy development of the overall sector. Leading and well-established players are going to win more opportunities," Chen said.

CreditEase has recently consolidated and upgraded its online lending business and has acquired a lending platform known as daokoudai.com, which offers loans and financial services for small and micro businesses.

"The industry needs to draw lessons from the past experience and to strengthen investor education and risk management capability," Chen said. "Online lenders will seek to diversify their capital sources from both individual investors and financial institutions. The prospect is still promising as the industry will continue to serve the financing needs of small business, rural residents and individual borrowers."

lixiang@chinadaily.com.cn

(China Daily Global 09/02/2019 page8)