How to move away from 'conflict stage'

Senior Yale academic says Washington's policies not in the best interests of China-US relations

Considered Wall Street's leading expert on China, Stephen Roach, senior fellow at Yale University and former chair of Morgan Stanley Asia, has spent more than two decades researching and writing about China.

His interest in China was first kindled in the late 1990s, when he realized how different it was from other crisis-battered Asian economies at the time and identified it as the key to end the Asian financial crisis.

During his long experience with the Chinese economy, leadership, policymakers and business people, he witnessed the economy undergo dramatic changes - integrating into and impacting the world economy, engaging in structural changes, and more recently advancing in innovative and cutting-edge technologies.

|

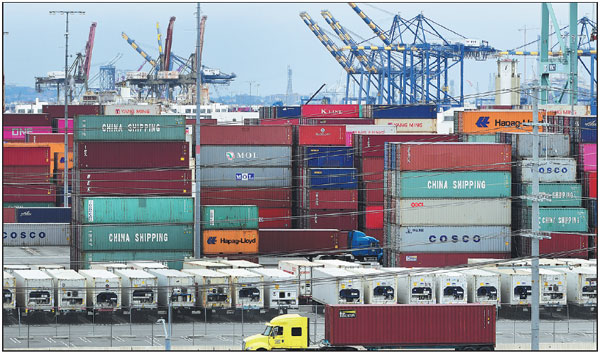

Containers at the Port of Los Angeles in San Pedro, California, on Tuesday. AFP |

Roach has also seen China and the United States develop a codependent relationship, in which the two economies need each other in multiple ways.

US consumers need low-price Chinese goods to make ends meet, the US Treasury needs China to buy US treasuries to fund the large and growing budget deficits, and US companies need China as the third-largest and most rapidly growing export market.

China, on the other hand, depends on the US as a large source of external demand for Chinese exports and depends on US financial markets to provide a benchmark for the currency.

However, over the years, after both countries, especially China, underwent changes, they've gotten into the classic "conflict stage" of codependency, as Roach described it in a recent interview with China Daily.

Almost a year ago, on July 6, 2018, the US imposed 25 percent tariffs on $34 billion worth of imports from China, a move that was soon answered by China with tariffs of the same scale.

That was the first round of tariffs exchanged by the world's two largest economies, as the Trump administration initiated this year-long trade dispute, which has extended into 25 percent tariffs on $250 billion Chinese imports from the US and various levels of retaliatory tariffs on $110 billion in US imports from China.

Not limiting its actions on tariff, the Trump administration has also targeted Chinese investments, industries, and even specific companies, with Chinese information and communications tech company Huawei, a frontrunner in the development of 5G technology, repeatedly caught in the crossfire.

The dispute was considered by US economists and global institutions, Roach included, as negatively impacting consumers and producers in both countries and the global economy.

In his interview with China Daily, Roach called the Trump administration's policies against Chinese imports and Chinese businesses an "aggressive economic action" against China and the wrong approach for a codependent China-US relationship.

While the US trade deficit in goods with China, which reached a record-breaking $419 billion according to the US Commerce Department, has been repeatedly condemned by the Trump administration, Roach stressed it is also an important outgrowth of internal, macroeconomic factors in the US, such as the low domestic savings rate.

Net domestic savings accounted for less than 3 percent of US national income in 2018, considerably lower from the 6.3 percent average over the final three decades of the 20th century, according to data from the US Bureau of Economic Analysis.

Roach suggested that the US economy needs "healing from within" to boost its domestic saving rate, while the Trump administration's deficit-prone fiscal policy is doing anything but.

China was only part of the US multilateral trade problems caused by a low savings rate, said Roach, as the US trade gap widened in 2018 to a 10-year high of $621 billion, and it had a goods deficit with as many as 102 nations.

Simply targeting China will likely just rearrange the multilateral deficit toward higher-cost producers, which taxes the US people, said Roach, who reiterated during the interview that tariffs are bad and trade wars are easy to lose - opposite to what President Trump has noted repeatedly.

The fact that trade accounts for 27 percent of US GDP, according to the World Bank's 2017 data, is making the economy more vulnerable to a collapse in global trade today compared to that in 1930, when trade accounted for just 11 percent of US GDP. Significantly, the Smoot Hawley tariffs enacted by the US in 1930 and the broad retaliation that followed played a key role in pushing the economy from a recession to the Great Depression.

That is something he believes is overlooked today, and thus suggested the administration be more careful in "launching this assault on the trade front."

During the interview, Roach also talked about what he thinks is the true nature of the current trade dispute, a "false narrative" - or criticisms without sufficient evidence - that prevails in the US against China, and his four-point proposal for how China and the US should navigate their trade and economic relationship.

What do you think about the current rhetoric in the US of "decoupling" the two economies?

I think that's an over-simplification of what's going on. The US has instituted or imposed significant tariffs on Chinese shipments to the US with threats to raise the tariffs shortly if there's no further progress on reaching an agreement. This isn't really decoupling. This is an aggressive economic action aimed at punishing another nation.

I think the real agenda here for the United States is aimed at a lot of China's future aspirations in terms of economic development - innovation and sustained economic growth. Whether it's the tariffs or the actions directed at Huawei, these are aggressive actions.

"Decoupling" makes it just sound like it's an innocent "you go your way, we'll go our way" - there's more to it than that.

In a recent white paper published by China on the trade dispute, China refuted several claims the US has been making, like the IP and the forced technology transfer issue. Do you think those criticisms made by the US are justified?

There are two sets of complaints that the US is really raising here. One is the bilateral trading balance - a big and growing US trade deficit with China that, as of last year, accounted for 48 percent of the total merchandise trade deficit that the US has. This has been a focus of President Trump's when he was running for office and continues to be a major focus of the discussions and potential resolution.

And then there's a whole set of other issues that we - for lack of a better term - called "structural issues" that deal with innovation policy, forced technology transfer, intellectual property rights, cyber (security), state-sponsored industrial policy - even the currency has now gotten into the debate. These are very tough issues that reflect, in many respects, the differences between two systems.

I've looked very carefully at the "structural issues." While in some instances the concerns that the US has raised are legitimate, the evidence in support of those allegations, especially the ones leveled by the US Trade Representative Robert Lighthizer in a long report that he submitted to the president in March of 2018, (is) surprisingly weak - evidence that actually could not be admitted into a US court of law if it was, in fact, attempted to do so.

And I'd just cite two things in that regard.

One, the accepted estimates of intellectual property theft that America suffers every year has been put in the range of $225 billion to $600 billion a year, and the bulk of that is attributed to China.

Where does this number come from? Good question. I looked at it. It comes from a very high-profile prestigious group called the IP Commission, headed up by former US ambassador to China Jon Huntsman (and) former director of National Intelligence Admiral Dennis Blair. Unfortunately, the estimates are weak. They have no direct way of measuring how much intellectual property is actually stolen by anyone, let alone China, and so they've created these phony models based on drug trafficking, illicit financial flows, and other bad characteristics of any economy, and used these models to come up with this ridiculously broad range of $225 to $600 billion.

Number two is the issue of forced technology transfer - the idea that companies that want to do business in China must do so in the structure of a joint venture, and one of the requirements of a joint venture, according to the US trade representative, is that American partners are forced - "coerced" - into turning over their technology to China.

Joint ventures, by definition, are voluntary arrangements where US companies willingly enter into a contract with the Chinese partner. And of course, when they do that, and their goal is to build a business together, there will be a perfectly normal degree of sharing of ideas, people, technology, product design and the like.

But the allegation that the US Trade Representative Lighthizer makes is that this transfer is forced, done against the better wishes of the American partner. That's a serious charge if that were to be the case. And yet he admits - on page 19 in his report, you check it - that there is no evidence to support what he's saying. And the only evidence that he uses is surveys from places like the US-China Business Council that seem to indicate that some US companies - a very large minority of them - are uncomfortable with doing business in China. That's very different than the allegation of forcing a company to turn over its core technology.

I was a senior executive in a joint venture in China - CICC (China International Capital Corporation Limited). I knew many businessmen who are senior executives and their respective joint ventures. None of them feel that there is a coercive aspect in which their technology is being taken from them.

Harvard professor Graham Allison has been warning about China and the US falling into the "Thucydides Trap." What's your take on this?

I think Professor Allison has done very interesting work, but I think the fears of a hot war are overblown. He studied the conflict between rising and ruling powers back over the last 500 years, and he has come up with 16 examples of conflicts, 12 of which have ended in military war. The last four did not, though. I think the power of weapons of mass destruction is so enormous right now, that the moral anchor of both countries would prevent that from occurring. But I think he was right to recognize the nature of the conflict in a broad, historical context.

My own sense is that, rather than worry about the hot war, we should be much more concerned about the likelihood of a cold war, which would be an ongoing conflict between the US and China, which, I think, has a very realistic chance of occurring. That would also be a negative for both countries if this conflict were to endure if we attempt to implement a superficial fix of these short-term differences.

You've written about a "false narrative" the US has on China, and in the US there's the tendency to bash China from not only the president, but by both political parties. Do you think this narrative on China will continue?

Unfortunately, we have a tendency toward creating a story to justify our actions. We did that against Japan, and we're doing it against China right now. This gets back to your earlier question on the allegations made by the trade representative and the work that I've done that draws many of those allegations into question. That, together with the focus in Washington on narrowing the bilateral trade deficit, is what I would call the "false narrative."

Are we going to wake up and say, "Oh, gee, we need to be more transparent and more truthful in going to a different narrative?" No, we're not. And we have, unfortunately, a lot of bipartisan support. Democrats and Republicans - the former party of free trade - united on very few things, but united in blaming China for America's growing economic middle-class problems.

Do you think the US should look into China's side of the story and China's repeated stressing of "mutual respect," and come up with more constructive solutions instead of citing tariffs as the only way out?

We have a president who has a clear view, as expressed under the general framework of the Art of the Deal, that the only way to negotiate is to be tough.

I would argue that in a relationship as important as that between the US and China, in a codependent relationship where China doesn't just depend on us, but where we also depend on China, the art of the deal and the aggressive attack that one partner (put) on the other is not the way to do it. We need the wisdom of a compromise, not the brute force of a tough negotiator.

The counterargument (is that) America has tried to negotiate for years and we've gotten nowhere, and so now we are trying a different approach and this is good. I think that is not (an) acceptable response. There are plenty of other options. I have written about four options myself that I think could change the outcome in a very significant fashion.

Number one, focus not on the bilateral trade imbalance, but on a bilateral investment treaty - market access, opening each country's markets to the other, wide open, by eliminating ownership caps on foreign investment across the board into China and into the United States.

The United States right now has 42 bilateral investment treaties with other countries. China has 145 of them. We were negotiating one for 10 years. We came very, very close. And now in the Trump administration, forget it, there's no discussion of it. And yet, if we were to agree on a bilateral investment treaty, we could eliminate foreign ownership caps and remove the joint venture as an operating structure in China and the United States. That would take this forced technology-transfer debate off the table because there would be no need for joint ventures. They'd be wholly owned subsidiaries.

Point two, more briefly, is both countries need to focus on committing macroeconomic saving adjustments. The US needs to save more. The only way to do that is to reduce our budget deficit. That would reduce our bias toward trade deficits with China and everyone else. China needs to save less, to fund the social safety net, to boost internal consumption. That would reduce China's trade surpluses.

Point three is cyber. Cyber is not a bilateral problem. It's a global problem. So we need a multilateral global solution, and the US and China have a great opportunity to take the leadership in forging a worldwide cyber accord, complete with metrics on cyber attacks, filing of disputes, and dispute resolution mechanism.

The fourth point is the nature of the dialogue between our two countries. We used to have these bi-annual big summits called the Strategic and Economic Dialogue. Then under the Obama administration, they reduced the frequency of those to once a year. And under Trump, there has only been one. And now all we have are dinner parties. We had a dinner party in Mar-a-Lago, the dinner party in the Forbidden City in Beijing, a dinner party in Buenos Aires, maybe a dinner party in Osaka - or as the way things are going, maybe tea.

But this isn't the way to run a relationship. We need a permanent office staffed by experts on both sides who are jointly sharing data and information, producing policy papers, and coming up with joint recommendations on policy. And I call this, for lack of a better term, a "permanent secretariat" - the US-China relationship deserves nothing less than that.

Those four issues - market access through a bilateral investment treaty, savings adjustments, leadership on a global cyber deal, and the structure of the dialogue, those are not in the debate. There's a complete mismatch between these four suggestions and what appears to be the focus of this "soybean strategy" to deal with the tensions focused on the bilateral trade deficit, which is meaningless and sort of ignoring the structural issues or, at best, just agreeing to negotiate on them.

You've described the relationship between US and China a "destructive codependent" one, and suggested it should turn to a more "constructive interdependent" one. How do you think that would be achieved?

I would like to think that there could be a more constructive, interdependent relationship as opposed to a destructive, codependent relationship. To get to that point is very challenging. It requires individual economies to be healthy from within rather than individual economies focusing on others as the source of their problems. This is a sea change, or this would be a sea change for the United States and for China.

But if you are stronger from within, you are more confident. You are better able to engage your partners from a position of strength as opposed to engaging them from a sense of feeling threatened in a position of weakness. I'm definitely in favor of shifting the character of the relationship from codependency to interdependency. Then, I think, there would be much greater opportunity for a lasting way out.

nancykong@chinadailyusa.com

(China Daily Global 06/21/2019 page9)