Benefits of globalization must be better shared

If trade tensions continue and escalate, China and the US will suffer the largest hurt, but other economies will also feel pain

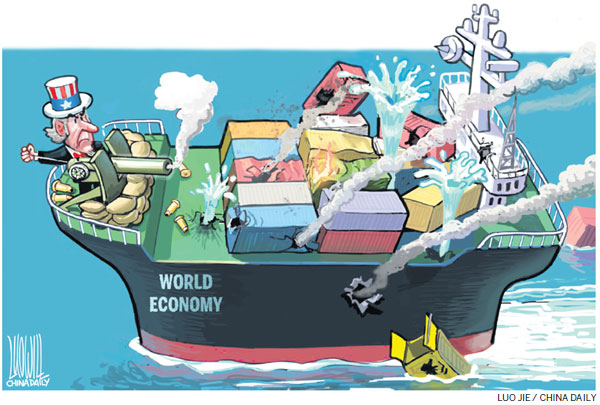

The trade frictions instigated against China by the United States administration will profoundly reshape the global economy. The raising of tariffs on US imports of Chinese goods followed by China's retaliatory measures is having negative impacts on output, investment, employment, productivity not only in both economies, but also in bystanders up and down global value chains.

In the short term, the direct economic losses are not negligible for both sides. Since the trade sector and manufacturing sector account for a bigger share in China's GDP, the estimated loss on the Chinese side in the short term is larger, ranging from 0.5 to 1.5 percent of GDP, and 0.3 to 0.6 percent of GDP on the US side, according to the latest World Economic Outlook of the International Monetary Fund. However, in the long term, the negative effects will become larger for the United States, as higher tariffs, often followed by real exchange rate appreciation, will lower the returns on capital.

Among all the economic factors, China-US bilateral investment has been affected most and may suffer more in the future.

Chinese foreign direct investment in the United States dropped 84 percent in 2018 compared to 2017, from $29.4 billion to $4.8 billion, according to a report by Rhodium Group. And US FDI in China stagnated at $26.9 billion, with the annual growth rate dropping from 11 percent to 1.5 percent in 2018.

Several factors have played a role here, largely on the US side. First, the uncertainty of economic prospects and investment policies brought about by trade tensions has made some investors shy away.

Second, the US administration has imposed new restrictions on Chinese FDI into the United States. Regulators such as the Committee on Foreign Investment in the United States and the Federal Communications Commission have blocked or reversed several investment deals in the name of national security.

Third, the Chinese government has also imposed some restrictions on capital outflows, although not specifically targeted at the US.

If trade tensions continue and escalate, China and the US will suffer the largest losses from tariff increases. And the impact on trade will be materialized in the years to come. In the worst case scenario, in which the US imposes 25 percent tariffs on all imports from China and China retaliates, an IMF simulation suggests that the trade volume between China and the US may slump by around 70 percent.

One explanation of this result is the trade pattern.

Processing trade accounts for roughly one-third of China's exports to the US, while general trade related with importing core intermediates from the US accounts for another significant share. Therefore, China's exports to the US and imports from the US are closely linked. So, when higher tariffs raise costs, some of this trade will be replaced by domestic supply or get diverted to a third country.

Thus, other countries not directly involved in disputes will also be affected due to the disruption of global production chains. Studies suggest that the global manufacturing sector will experience a significant contraction.

Economies with both relatively big and fragmented manufacturing sectors, such as Germany and Japan, will also suffer heavy losses if this course is taken.

Although some economies will benefit from the trade disruption, such as Canada and Mexico given their geographical and economic proximity to the US, simulation results show that the overall effects are small but negative in every region in the long run.

The spillover effects also include sectoral reallocation across countries and repositioning of global value chains.

The US agricultural sector will experience a considerable contraction. And the electronics and other manufacturing capacity in China will partly relocate to Mexico and other Asian countries such as Vietnam and Indonesia, while the service sector will substantially expand in China and contract in other countries.

This will imply job losses in specific sectors in China, which will tend to be bearable with the right policy reactions, since the losses can be accommodated with structural change to the economy.

Two main policy implications emerge here. First, it is important for China's central bank, the People's Bank of China, to maintain a moderate expansionary monetary policy to act as a buffer against the negative effects of the slowdown in the growth of exports, investment and consumption, and take measures to stabilize expectations of the exchange rate. To achieve this, it is essential to balance cross-border capital flows. This means further tightening capital controls if necessary and opening up the domestic financial market to encourage more portfolio investment inflows when direct investment staggers. Meanwhile, the central bank will need to closely monitor and strengthen regulations on short-term capital flows to avoid financial risks.

Second, China should keep seeking close trade relations with other valuable trading partners, for instance with European countries and the members of the Association of Southeast Asian Nations, and explore the trade potential with the Belt and Road economies. Since a driving force behind the recent anti-globalism is unevenly shared benefits from trade and the burden of structural adjustment across countries and sectors, it is important to have coordination mechanisms and policies in place to make sure economic costs do not fall on just a few.

The author is an assistant researcher of the Institute of Economics at Chinese Academy of Social Sciences. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

(China Daily Global 06/20/2019 page13)