Flavor a good match for China's increasingly sophisticated taste

Not-too-sweet, energy-boosting matcha gaining popularity in desserts and drinks

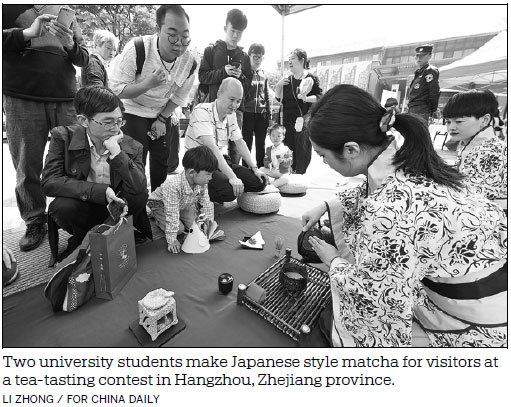

There's a growing niche in China for matcha and related greenish desserts and drinks, such as matcha-flavored layered cake, ice cream and lattes.

As an indication of just how much the flavor has triggered the appetite of appearance-and quality-conscious Chinese consumers, a search of the word "matcha" through Dazhongdianping, a Chinese customer review app that is similar to Yelp, results in about 5,000 specialty stores in Beijing alone. And most reviews from consumers said they like the taste.

"Dessert in matcha flavor are not too sweet, and it tastes better to feel the sweet out of light bitterness. I also like the exquisite look of green desserts, such as matcha cake and ice cream," said Tian Shen, a 27-year-old bank employee in Beijing.

|

A customer buys matcha-flavored desserts at a matcha store in Beijing. Du Lianyi / China Daily |

The selling point of matcha comes from its look, taste and function. It takes a series of complicated technologies from picking leaves to grinding, and every production process has certain strict standards, industry experts said.

Matcha, which "originated in ancient China and later thrived in Japan ... is something that can meet the demand of healthy lifestyles, and it can also satisfy the pursuit of positive feeling and experiences from consumers. With an increasing number of Chinese traveling abroad and the integration of different cultures, more Chinese consumers are expected to like matcha food", said Neil Wang, president of consultancy Frost & Sullivan in China.

"Many matcha specialty stores in China are well-decorated, and distinguished decoration styles can help to better promote the green, organic and healthy features of food. Beautiful and stylish stores can also attract more consumers and they may like to take pictures and post them on social media, which helps to further promote the stores," he said.

By 2024, the value of the matcha market in Asia, led by Japan and China, is predicted to exceed $1.5 billion, and the application of matcha in food will become more prevalent, according to Global Market Insights, a US market researcher and consultancy.

Globally, the demand for matcha is around 12,000 metric tons per year. Currently, the total annual output of matcha is around 4,000 to 5,000 tons, and there is a shortage of 7,000 tons to 8,000 tons, according to China Food Newspaper.

Wang of Frost & Sullivan said the younger generation of Chinese consumers is focused on healthy food and drinks. Matcha contains caffeine, but unlike coffee, it won't make people feel nervous, as matcha also contains theanine. The combination of theanine and caffeine helps to alleviate pressure, but still makes people feel energetic.

"Matcha contains a high level of protein, amino acid and chlorophyll, and its content of caffeine and tea polyphenols is relatively low. The complicated technique of producing matcha makes it easier for nutrient absorption, and the high degree of refinement makes it easier to be applied to different food and beverages," Wang said.

"For the matcha sector, China needs to further explore planting techniques, manage the planting scientifically, and strengthen the training of professional talents. Compared with traditional tea, matcha has natural advantages by leveraging the strength of other consumption goods," he said.

Wuxie, China's first brand that mainly sells Japanese style matcha desserts, opened its first store in October 2014, in Nanjing, Jiangsu province. Now, there are hundreds of matcha brands and desserts of different styles nationwide, including Guantea, 36 Matchart and Qingchu Matcha.

At many of those stores, matcha-flavored ice cream offers three kinds of flavor profiles, the concentration of matcha can be 30 percent, 60 percent and 90 percent. Most of the sweet offerings on the menus retail at 20 yuan ($3) to 40 yuan.

Wang Zhibin, director of the American Chinese Food Federation, said for any cuisine, raw food materials are the most important. If he were to label matcha, he said, he would use the terms "fashionable" and "healthy", and he believes its growth prospect is promising.

"Matcha can be applied to various kinds of food. We have held some events to promote matcha desserts and other Chinese food combined with matcha in the United States, and we have seen great interest locally. This can help international consumers to have a better recognition of Chinese food culture," he said.

Wang Jianjun, deputy general manager of the merchandise department of Benlai, an online shopping platform for fresh food in China, said matcha serves as a great example and result of the ongoing consumption upgrade trend in the country.

"Currently, there are not many matcha-related products sold on Benlai. We would like to introduce more matcha products online, as we believe in its growth potential. Younger Chinese consumers who were born after 1990 and 2000 are more receptive to new products," he said.

Compared with Europe, the United States, Japan and South Korea, Chinese consumers' spending on snack food and their per capita consumption volume is still relatively low; therefore, the market for leisure food still has considerable growth potential, Frost & Sullivan found.

"The demand for healthy, safe and high-end leisure snacks will continue to expand in China. Fueled by the growing consumption upgrade trend, the scale of snack food in the country will increase steadily," Wang of Frost& Sullivan said.

"Higher-end leisure food will account for a larger market share, which will help to boost the prices and volume of the overall market. Particularly, the growth rate of leisure food through e-commerce platforms and specialty stores will be faster than that of traditional supermarkets," he said.

This year, the market size of street stalls and food service kiosks in China is expected to reach $13.96 billion, followed by the market scale of India, and ahead of the United States, Thailand and Mexico, according to market researcher Euromonitor International.

By 2023, the market size of street stalls and food service kiosks in China is forecast to reach $19.48 billion, adding 40 percent over the level of 2019, Euromonitor International found.

zhuwenqian@chinadaily.com.cn

(China Daily 05/01/2019 page9)