Building business quickly, but thoughtfully

Visa is getting capabilities and infrastructure ready to participate in China's mobile payment market

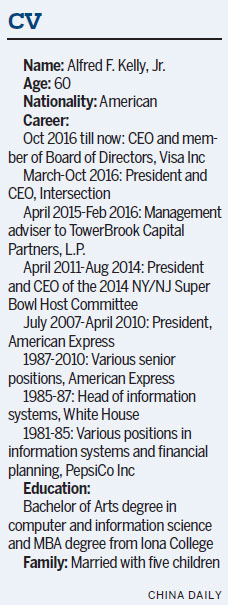

Visa Inc has applied for a bank card clearing license in China as a wholly owned foreign enterprise, said Alfred F. Kelly, Jr., CEO of the leading global payments technology company.

This choice is different from its major competitor Mastercard Inc, which is resuming a push into the country by forming a joint venture with China's online clearing house NetsUnion Clearing Corp.

"Our competitors will do what they think is best; we are going to do what we think is best for Visa," Kelly said on the sidelines of the annual China Development Forum recently.

"Obviously, it is important to get the form of what we do correct, and it is important to be compliant with the People's Bank of China's rules and guidelines.

"But equally important is to make sure that when we come to the market, we are delivering value and benefit that is going to be desired by Chinese citizens and business owners, and that we are bringing solutions and innovations that are going to be relevant and valuable to China," Kelly said.

"Visa is spending a lot of time thinking about what it will deliver. That is equally important to how we enter the marketplace," the CEO added.

The company expanded its Beijing office to a new building and opened its China Innovation Center in the capital city on March 22, in an effort to encourage clients and partners - including banks, merchants and fintech companies - to develop solutions for customer pain points.

"These are signs of our willingness to invest ahead of having a domestic license approved, because we are both confident and hopeful that can happen," he said.

In an interview with China Daily, the CEO shared his thoughts on a number of topics, such as Visa's application for China market entry and plans for local business development.

How is Visa's application for direct access to China's bank card clearing market progressing?

We have filed our application and are in continued discussions with the People's Bank of China. We are hopeful that our application will be accepted soon, and we are planning accordingly.

We are so excited about what this market could be that we are thinking about capabilities and infrastructure required from a technological standpoint and getting ready.

We are kind of going down two paths: One is to continue to have ongoing engagement with the PBOC and other relevant people in the Chinese government, to make sure that we are doing everything we need to do to be 100 percent compliant with what the government expects of us in terms of being a good operator in this country. And we are planning how we will operate in the market if it were to happen.

Alipay and Tencent account for more than 90 percent of the mobile payment market in China. With the entry of Visa and Mastercard, will the market landscape be reshaped?

I believe that the Chinese government is embracing the idea of opening their markets because they want to see more participation. More participation leads to more innovation. More innovation leads to more choices for consumers and small business owners.

At Visa, we look forward to competing with whoever is in the marketplace, and I believe that new players make everybody raise their game in terms of what they are offering to consumers and small business owners.

We are excited about the prospect of participating in this market. We don't have any illusions that on day one we will be a big player. We are in this for the long term.

I look at China as an opportunity for the next two or three decades at least. We are going to be patient and to build the business quickly, but thoughtfully.

In order for all boats to rise in terms of payments in China, there are two things that are going to be important.

One is that the playing field is even so that the rules and regulations for everybody are the same; the second is that there is an embracing of industry standards so that solutions are interoperable, and merchants and banks don't have to build different technology bases for all the different payment players. That would be great if it is all kind of plug-compatible because we are following industry standards and we are focused on interoperability.

What trends have you seen in the Chinese payment market during your visit to Beijing? How will Visa make the best of these opportunities once it obtains a license?

Every time I come to China, I try to spend a little bit of time walking around, visiting restaurants, small shops and kiosks to get a sense of how people are buying and what they are buying.

This is a truly unique market. There is no market in the world that has embraced mobile payments to the degree that China has.

I've been in the payments business for 30-odd years. One of the things I have learned that gets reinforced every day is that payment is very much a local business.

For us to be successful, we must be relevant locally. When we think about solutions in China, we've got to be conscious of the regulations, the history, the traditions and the realities of the Chinese market.

If we are fortunate enough to begin operating here in China, clearly we will have to bring mobile-based payment solutions into the market and ideally, to have new and different types of innovative ideas and capabilities that would give us and our bank partners the opportunity to bring new products to Chinese citizens.

How does Visa plan to push ahead with its business in China? Do you want to use a QR-based model or the traditional model?

We are completely realistic about the fact that while we are a big global company, we must act locally when we come into a particular market. Whatever is the right way to deliver solutions to the marketplace - mobile, QR, tap and pay - whatever we need to do in terms of capabilities to be relevant to build our business and brand in China, we will do.

So we close no doors. We listen and look hard at the marketplace.

We don't make decisions at the corporate level about what we do at the local level. The local level is the best judge of what we need to do to be successful in a market. What we try to do at the corporate level is to provide investment dollars and a set of tools that can be as customized as necessary for a local market anywhere in the world.

How would the further opening-up of China's financial sector affect your business?

This is an exciting, large and vibrant country. Businesses from around the world are anxious to be part of this society. They will come here with their best ideas and their brightest people to bring all kinds of new innovations, products and solutions to Chinese consumers and small business owners. That is a positive thing for the people in China.

Outside China, it sends a terrific message to the world that China is welcoming and open for business and wants to have many companies bring their products, services and value to the Chinese people.

jiangxueqing@chinadaily.com.cn

(China Daily 04/04/2019 page9)