Deputies' spotlight on housing

Focus on market's healthy long-term development to brighten economic outlook this year

The annual two sessions of China's top legislature and top political advisory body, which ended on Friday, once again focused attention on the direction of the real estate market, particularly the residential segment, a key economic concern.

Although the bullish stock market has stolen realty's thunder of late, industry experts said intense discussions on micro controls, property tax and long-term real estate mechanisms have shifted the economic spotlight back on to property this month.

The two sessions are always closely watched by all the key economic sectors, and property is no exception, as the meetings of deputies, or China's lawmakers, set the tone for related policies.

|

A prospective homebuyer (left) consults a salesperson for details while reviewing the model of a housing project at a developer's sales office in Chengdu, Sichuan province. Huang Jiaming / For China Daily |

"Conventionally, we can read the policy focus for the coming year from the two sessions, and the Government Work Report delivered by the Premier in particular," said Regina Yang, director and head of research at Knight Frank, a real estate consultancy.

"The Premier stated that improving the local taxation system to gradually promote the legislation of property tax is one of this year's tasks. This suggested the tax will be part of the long-term mechanism for the property sector in the future," said Lu Wenxi, a researcher with Centaline Shanghai, a property consultancy.

Experts said the proposed property tax, which has stirred heated debates for a decade now, could well become reality in the years to come.

"The procedure for a property tax law has been progressing, and media reports suggest it could be submitted to the Standing Committee of the National People's Congress (China' top legislature) for deliberations later this year. So, it could possibly take effect in the year 2021 or 2022," said Chen Sheng, president of the China Real Estate Data Academy.

"As of now, the issue of the proposed property tax has attracted a lot of public attention. The market has changed its attitude toward it. From doubting its possibility, the market has traveled to widespread common sense. Everyone now thinks it's just a matter of time before the tax becomes a reality," said Liu Tianyang, vice-president of Centaline for the Chinese mainland, and president of Yuancui Information Technology, which is a fully owned subsidiary of Centaline Group.

"The Government Work Report stated that China will stick to city cluster development, ensuring policy support for developing major city clusters in the Yangtze River Delta region, the Beijing-Tianjin-Hebei region and the Pearl River Delta region," said Lu.

Economic collaboration and balanced layout within the city clusters will narrow the gaps between the cities and benefit the regions as a whole, he said.

"The recently announced Guangdong-Hong Kong-Macao Greater Bay Area plan that is set to boost South China will bring about great opportunities, and the property market will be one of the first sectors to benefit," said Yang of Knight Frank.

Compared to previous years, property speculation was not mentioned in this year's Government Work Report. This suggested the property market has shown signs of cooling under consistent micro control policies, according to Lu.

In 2018, realty-related policies were tightened a record 400-plus times to rein in runaway property prices in Chinese cities.

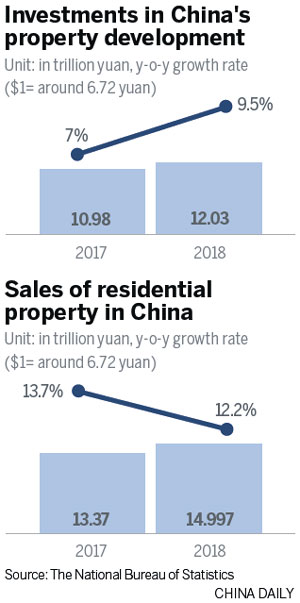

Against such a backdrop, total revenue on land transactions across the nation hit a record 6.5 trillion yuan ($970 billion) in 2018, up 25 percent year-on-year, according to data from the National Bureau of Statistics.

The surge in land transactions was in line with the record home transactions in 2018, which were valued at 15 trillion yuan, up 12 percent year-on-year.

"From my understanding, the keynote for the property market will be keeping the market stable, to align with the central government's spirit," said Chen.

"For property micro controls, the central government has granted local governments more power to adjust policies, based on their respective situations. That means, local governments can adjust their real estate policy according to local conditions. This gives local governments more flexibility, while avoiding the systemic risks that could be brought by unified control," said James Shepherd, who heads China-related research at Cushman & Wakefield.

Barring a few cities' policy relaxations through minor controls, there was no major change in the central government's real estate regulation policy. Stable growth and risk prevention remain the cornerstone of the real estate market regulations, and the central government retains a strong say to control financing and the flow of funds.

"All the efforts already made and will be made, be they micro control policies or reforms - they will serve the government's ultimate goal of forming a long-term mechanism for a stable property sector. They will make sure China's real estate market is healthy, standardized, stable and continually developing," said Liu of Centaline.

According to Shepherd, the long-term mechanism for real estate stability will likely include five key elements: finance, land, taxation, investment and legislation.

The mechanism, even though unlikely to be established quickly, will aim to increase land supply, underpin the leasing market and restrain investment speculation through financial means.

This year, the government will likely focus on continuing to promote the long-term scheme in 16 key cities (four first-tier cities and 12 key second-tier cities), to be followed in the rest of the country.

Given the long-term nature of the mechanism, it will take a while for it to be explored fully and implemented carefully. So, results ought not to be expected in the short term, industry insiders said.

However, the mechanism may reshape China's real estate market once it is fully implemented, said Shepherd of Cushman& Wakefield.

Liu expects the mechanism to reflect Chinese characteristics after factoring in the experiences of other nations and regions as reference points.

"It will enable all participants to fully play their roles, all the resources to get optimized and the real estate sector to operate effectively."

Experts agreed the real estate market is going to remain stable in the next 12 months, though some local governments will likely moderately relax local restrictions on homebuyers. But, the overall market will not change substantially as key factors like capital and credit are expected to be stable.

Stepping up urbanization is an important task for China in the foreseeable future. That requires balanced development of residential property, infrastructure and public services.

China is aiming to help 100 million non-native residents (those that mostly live in urban areas, but are registered in their rural birthplace) to receive hukou, or household registration certificates, in cities, by 2020.

Shepherd said: "This creates certain opportunities in China's real estate market. People who live in the city without a hukou may face hurdles regarding their children's education, social insurance and so on.

"With the promotion of new household registrations in cities, non-native residents may be more inclined to purchase homes, which will likely boost urban property sales."

wang_ying@chinadaily.com.cn

Top 100 developers suffer sales plunge

BEIJING - China's top 100 real estate developers saw a sharp 23-percent month-on-month decline in their total sales volume in February due to the Spring Festival holiday, Economic Information Daily reported on March 11, citing an industry report.

The year-on-year decline in February was 11 percent, according to China Real Estate Information Corp, an online industrial information provider.

Floor area sold by Vanke, China's housing market giant, plunged 22 percent to 2.47 million square meters in February, with the sales falling 12 percent to 43.19 billion yuan ($6.4 billion) month-on-month.

CRIC attributed the falling turnover to unexpected cooling in the real estate market of third - and fourth-tier cities last month.

The housing markets in the cities of Xuzhou, Huai'an and other smaller cities, which are mainly dependent on migrant workers who want to purchase property in their hometown, saw a significant drop in property sales, according to CRIC.

China's real estate sector has been expanding at a slower pace in recent years due to government control measures. Property sales in value gained 12 percent in 2018, down 1.5 percentage points from the previous year.

China's top legislature has been stressing long-term health of the residential property sector.

Xinhua

(China Daily 03/18/2019 page8)