Intangible assets key component of value

WIPO identifies rights, design, tech as driving forces of products' worth

Intangible assets, especially intellectual property portfolios, have become a major contributor to products' value, according to a report released by the World Intellectual Property Organization.

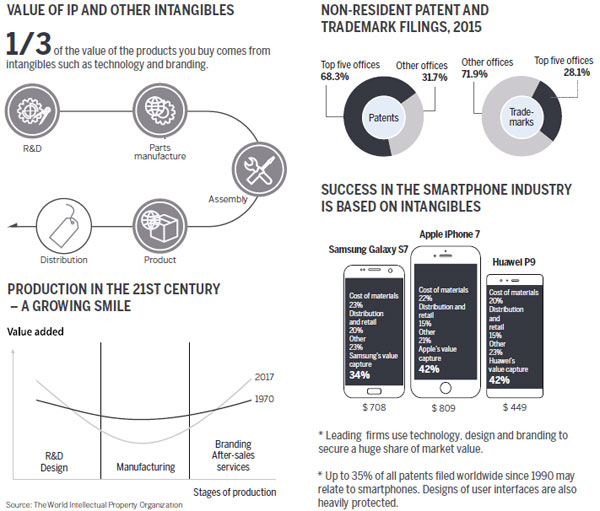

WIPO gave the first-ever figures revealing that nearly one-third of the value of manufactured products sold around the world comes from intangible capital, such as branding, design and technology.

The World Intellectual Property Report 2017: Intangible Capital in Global Value Chains, unveiled in Geneva, Switzerland last week, showed that intangible capital contributes twice as much as buildings, machinery and other forms of tangible capital to the total value of manufactured goods.

"Intangible capital will increasingly determine the fate and fortune of firms in today's global value chains. It is behind the look, feel, functionality and general appeal of the products we buy and it determines success in the marketplace," said WIPO Director General Francis Gurry.

"Intellectual property, in turn, is the means by which companies secure the competitive advantage flowing from their intangible capital," Gurry said.

The WIPO report looks at how much income accrues from labor, tangible capital and intangible capital in the global production value chain across all manufacturing activities, with case studies focusing on coffee, photovoltaics and smartphones.

Rising up the ranks

As an IP powerhouse, China is well positioned in all three industries, as Chinese companies are participating in global value chains by establishing their own intangible assets.

In the photovoltaics sphere, the vast majority of patents are filed in China, Germany, Japan, South Korea and the United States, with Chinese innovators emerging as the largest source of patent filings as of 2010, according to the report.

Participation in the photovoltaics global value chain has shifted markedly over the last decade, in particular with the relocation of upstream and midstream production activities to China.

Chinese companies have benefited from attracting skilled engineers and executives from abroad, bringing technological expertise, capital and professional networks to China.

Solar panels have transformed from highly specialized products to lower cost commodities. Between 2008 and 2015, prices fell by an estimated 80 percent.

The shift in global value chain production - combined with the steep fall in solar panel prices - has left many traditional photovoltaics manufacturers facing greater competitive pressure, which partly explains the decline in related patent filings worldwide after 2011.

While the decline has been sharp in the US, Europe and Japan - the sector's traditional sources of innovation - China is the only major patenting origin to have seen continued patent growth after 2011.

Smartphone firms and technology providers rely heavily on patents, trademarks and industrial designs, generating a high return on their intangible capital.

The WIPO report estimated up to 35 percent of all first filings worldwide could relate to smartphones.

Chinese industry players have rapidly upgraded their technological capabilities.

The report cited Huawei as an example of the evolution from a manufacturer of telecommunications equipment and low-end mobile phones, into a leading supplier of high-end smartphones, investing heavily in research and development and building up a global brand.

Other Chinese smartphone suppliers, such as Xiaomi, Oppo and Vivo, have also joined the ranks of the top 10 by global sales.

Studies have identified East Asia, Europe and North America as the three regional blocks with the strongest supply chain relationships.

While Japan, Germany and the US have been the leading headquarter economies in those regions, China is increasingly entering the more technology-intensive upstream production stages.

Data from the State Intellectual Property Office show that roughly 21,200 international patent applications filed via the Patent Cooperation Treaty were from China in the first half this year, an increase of 16 percent year-on-year.

(China Daily 11/30/2017 page17)