Leveraging technological prowess for innovative financing

As the only representative from China's financial technology industry to speak at the 2016 APEC CEO Summit held in Peru later this month, which comes hard on the heels of the G20 Leaders Summit in Hangzhou in September, CreditEase founder and CEO Tang Ning has much to share concerning innovation.

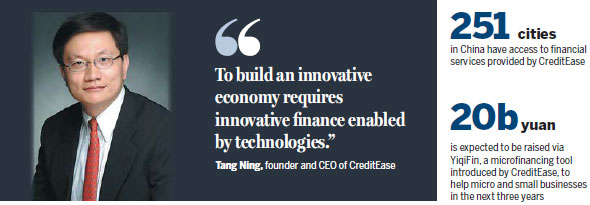

"To build an innovative economy requires innovative finance enabled by technologies," Tang said, prior to his departure to Peru, where he is due to participate in a discussion on the economy and innovation at the meeting on Saturday.

"CreditEase has accumulated substantial expertise in helping entrepreneurs and small and medium-sized enterprises, and itself is also an enterprise born out of an innovative economy," he said.

Since its founding in 2006, the Beijing-headquartered financial technology company has grown from being a startup to a top peer-to-peer lender worldwide and one of the leading wealth management companies in China. In 2015, the company's peer-to-peer arm Yirendai listed on the New York Stock Exchange.

Leveraging its financial technological prowess in big data and the internet of things, the company focuses on inclusive finance, wealth management and financial technology innovation.

In pursuit of innovations in theories, business modes and technologies, CreditEase has expanded its service network to 251 cities and 93 rural areas in China over the past decade.

Financing for all

One of the Chinese government's targets for the 13th Five-Year Plan (2016-20) is to create new jobs for more than 50 million people in urban areas and help impoverished counties nationwide lift themselves out of poverty, according to the government report released at the annual National People's Congress in March.

While the championing of mass entrepreneurship is in full swing across the country, a large number of SMEs, especially in rural areas, face financing bottlenecks due to a lack of access to financing or lack of collateral for traditional loans.

More than 90 percent of the company's microfinancing clients need less than 100,000 yuan (about $14,500) and the average demand in the segment is around 50,000 yuan.

"We're trying to help them to establish credit profiles, access credit facilities and secure insurance through an innovative model and technology, through peer-to-peer credit loans that require no mortgage or security, and through crowdfunding," Tang said in an earlier interview with China Daily.

For instance, the company has been working closely with the Hainan Equity Exchange Center to provide crowdfunding services to local agricultural businesses since 2015.

As of September, six crowdfunding projects had been launched and high-worth transactions were clinched online, said Ban Miaoqi, general manager of the center.

Beneficiaries of the crowdfunding services include An Shuoyu and Huang Xiaoling. The couple, who fell in love at university, run a grapefruit growing business in Hong'an, Hainan, weathering the mess in their grapefruit plantation following a severe storm and the difficulties in the early period of their operation.

They raised more than 60,000 yuan via the crowdfunding platform within seven days and plan to expand their production.

YiqiFin was introduced by CreditEase as a financial service tailor-made for SMEs. It aims to raise 20 billion yuan to help more than 20,000 micro and small businesses in the coming three years. Another financing tool Yinongdai has raised 200 million yuan, which has helped more than 20,000 women start up farming businesses.

Globalized opportunities

In addition to inclusive finance, CreditEase's business portfolio includes helping Chinese high-net-worth individuals - those with $1 million or more to invest - allocate their assets worldwide.

"Financial innovation enables millions of high-networth individuals to participate in innovation by providing funds to innovative startups and entrepreneurs," Tang said.

Currently some 3,000 wealth planners at CreditEase branches across more than 40 cities on the Chinese mainland provide one-on-one financial advice to clients.

Besides branches on the mainland and in the Hong Kong Special Administrative Region, the company also has offices in Singapore, the United States and Israel that focus on the local markets and opportunities in these countries. These units also design investment products and conduct risk control as well.

Tech-powered innovation

The company also helps investors to manage their wealth using robots.

A computerized investment advisory service called ToumiRA, or "robo adviser", launched by CreditEase in May, helps to build investment portfolios using algorithms after investors have completed a questionnaire about their investment goals and risk tolerance, according to the company.

"The automated wealth management service is a smart and scientific technology on mobile terminals that individual investors can use to invest globally and inexpensively," Tang said.

According to him, the computerized "robo adviser" can assess reports from hundreds of clients a day.

"In traditional wealth management, no more than 10 such reports are assessed by experts a day. Thus, the automated wealth management service will greatly decrease the money spent on experts and increase efficiency," Tang said.

Without technological innovation, risk management could not work, he said.

"We will continue to increase investment in technological systems and data models for smarter credit management and risk control."

Qiu Quanlin and Sophie He contributed to this story.

zhuanti@chinadaily.com.cn

(China Daily 11/19/2016 page12)