Favorable tax policy could be extended

|

Favorable purchase tax in China may help push auto market growth, said industry insiders. Provided to China Daily |

One-year extension is on the cards for duty rules that supporters say have boosted the market for small engine vehicles, Hao Yan reports.

China is likely to extend its favorable purchase tax policy on small engine vehicles to further boost the market's growth, though some have suggested tax reform to further discourage the "gas guzzlers".

Sources familiar with the matter said the country's government bodies discussed the vehicle purchase tax policy on Nov 1, with some ministries expressing firm support for a one-year extension. However, the decision makers are still surveying, an official told The Economic Observer in anonymity.

"The tax policy may help unleash five to six percentage points of growth in the nation's automobile market," said Dong Yang, executive vice-president of the China Association of Automobile Manufacturers, on Oct 28. "With the extended policy, market growth could reach up to 8 percent, but without it, growth could touch as low as 3 percent."

The China Association of Automobile Manufacturers believes the policy has been the major savior of the domestic car market. The association is lobbying the State Council, China's cabinet, to extend the policy if necessary.

CAAM's statistics showed that cars with engines no larger than 1.6 liters contributed nearly 67 percent to total sales volumes in the first nine months. The proportion in the same period last year were lower than 63 percent.

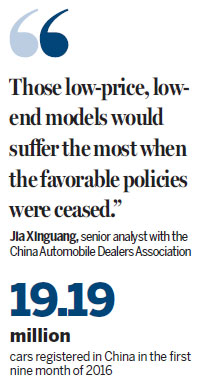

From January 1 to September 30, the country saw a total of 19.19 million new cars registered, jumping 14.6 percent year-on-year, according to the Ministry of Public Security.

The Chinese central government introduced a stimulus measure in October 2015 which halved the tax to 5 percent on purchases of passenger vehicles powered by engines no larger than 1.6 liters. But the policy is due to expire by the end of this year.

Jia Xinguang, a senior analyst with the China Automobile Dealers Association, suggested prudent consideration of the policy extension, despite encouraging the purchase of energy-saving cars with smaller engines. He claims that each time the country repeats the same policy, its effect diminishes.

"The halved tax policy was applied in 2009 and 2010, and helped boom the market with a 46-percent annual surge. But history won't repeat itself," Jia said. "The market volume base is expanding, so we can't expect the policy to fuel acceleration in 2017 as high as that of this year."

Policy substitutes

On the other hand, the policy substitutes include reform for taxation to further benefit smaller car buyers.

Chinese media reported that the Ministry of Finance is mulling over the possibility of merging the vehicle purchase tax into consumption tax to better popularize the small cars and discourage the "guzzlers".

The drafted vehicle consumption tax may lower the universal 10-percent rate to 1 percent on cars with engines no larger than 1-liter, but charge 40 percent on those larger than 4 liters. The rate for 3- to 4-liter vehicles would be 25 percent.

Jia noted that "the country needs to balance the burdens brought by tax cuts, because the policy was actually bringing a fiscal burden to the country. And a simple tax cut seldom helps the automotive industry change."

The country might lose a total of 72 billion yuan ($10.7 billion) in tax revenue throughout the tax cut period from Oct 2015 to the end of 2016, according to China International Capital Co's estimate last year.

Dong pointed out that when dealers and buyers do not see the possibility of a favorable policy in 2017, the market may encounter an overdraft in the two months, followed by a slow-down next year. Many dealers and buyers will try to close the deal as soon as possible this year in November and December, ahead of their original plan for 2017.

Dong said: "Given such a historical volume record in the world's largest market, a minor bump in development won't matter in the overall situation."

Another substitute stimulus measure suggested is to give subsidies to small vehicle buyers in rural areas, described as "automobiles going to the countryside".

The subsidies were given to rural residents from March 2009 to the end of 2010. Buyers who scrap an agricultural tricycle or low-speed van received a subsidy equivalent to 10 percent of the sticker price of a newly-purchased car powered by an engine no larger than 1.3 liters.

That round of countryside subsidies unleashed the rural population's demands on small-sized, multi-purpose vehicles, and drove Chang'an Star and SAIC GM Wuling Hongguang to become nationwide bestsellers. Wuling Hongguang, with its upgraded models, has been staying in the pole position since 2010.

Jia viewed these low-end vehicles as carrying very limited technical content, and believes their volume would not help the Chinese automotive industry's evolution.

He said: "Those low-price, low-end models would suffer the most when the favorable policies were ceased, as their customers are very sensitive to price fluctuations."

Contact the writer at haoyan@chinadaily.com.cn.

(China Daily 11/07/2016 page18)