ROK insurer prospers after Anbang's takeover

|

Yao Dafeng (left), chairman of Anbang Life Insurance Co Ltd, meets with Park Byung-Moo, CEO at Vogo Capital Advisors Ltd (VIG Partners), at the contract signing ceremony in Soul, South Korea. Son Yujung / For China Daily |

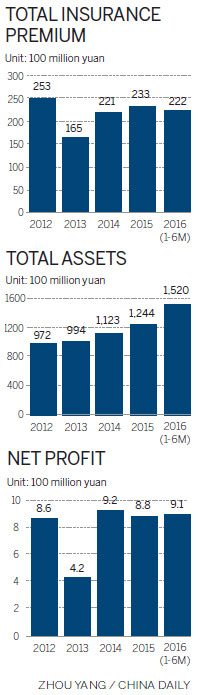

Tongyang Life Insurance Co has become a leader in income growth in the South Korean market in the first half of 2016, after being acquired by Anbang Life Insurance Co Ltd in September 2015.

During that period, the South Korea-based company's premium income saw 90 percent growth from the previous year and its profits hit a record high.

"It's a success Anbang achieved in its overseas investments under the guidance of China's Belt and Road Initiative," said Wu Xiaohui, chairman and CEO of Anbang Insurance Group.

"The results prove Anbang's operation strategy of innovative hand-in-hand cooperation with business partners, sharing resources and therefore achieving win-win success."

According to Tongyang Life's figures, in the first six months of 2016, the insurer's premium income reached 3.7 trillion won ($3.29 billion), a 90-percent growth, which lifted its rank from ninth to fifth in the South Korean market.

The company's profits reached 151.8 billion won, up 19 percent year-on-year.

Premium income and profits reached a 79.6 percent and 96 percent of the company's full-year target, the best results since the company started in 1989.

"Encouraged by the Belt and Road Initiative, Chinese companies going out has become the norm," Wu said. "As we expand our business overseas, we also bring dynamism and vitality to the economies and countries in which we invest, following Anbang's business philosophy of co-building, sharing and win-win."

Tongyang Life, headquartered in Seoul, used to be a mid-sized insurance company in South Korea. Before Anbang's acquisition, similar to other insurers in South Korea, it faced the challenges of low interest rates, slow growth and an aging society.

Gu Han Seo, Tongyang Life's CEO, said that after Anbang took a controlling stake in Tongyang, it introduced some new approaches to encourage innovation in products and services, and to improve internal management.

First, to promote product innovation, the company launched a pension insurance product at the beginning of this year, which generated premium income of 1.6 trillion won.

That single product grew rapidly in popularity and contributed 43.2 percent of total premium income and 30 percent of overall profits for the first half of 2016 alone.

Helped by such initiatives, Tongyang's total assets rose to 25.4 trillion won, up 12.4 percent from the beginning of 2016, making it the only insurer to have registered double-digit growth among South Korea's 10 largest insurers.

As for service innovation, Tongyang focused on overseas markets, especially in its exchanges with China.

In recent years, the low-interest environment in South Korea has affected the country's life insurance companies, limiting their ability to offer high returns to policyholders. In such a low-interest environment, insurers there generally reduce the proportion of deposit insurance products to avoid interest risk.

Before being acquired by Anbang, Tongyang also faced challenges from a changing market and general social situation in South Korea. However, Anbang's global reach made it possible for Tongyang to diversify risks by expanding its investment products into different areas.

In the first half of this year, leveraging Anbang's global business, Tongyang explored some overseas investment channels. By June, its investment in overseas bonds amounted to 1.2 trillion won, up 39 percent from December 2015.

The ratio of managed assets also increased from 10 to 15 percent.

With assistance from Anbang, more and more South Korean companies and Chinese businesses operating there have been able to invest in the Chinese market through Tongyang Life.

Insurance industry analysts have noted that Anbang provides Tongyang with the opportunity to allocate assets in the Chinese market with a return rate 5 to 6 percent higher than in South Korea, enabling the insurer to sell deposit insurance or variable life insurance products and thereby grab more market share.

Tongyang's management team believes that increasing overseas asset investments and broadening investment channels is essential to helping Tongyang reduce risk and boost investment returns.

Tongyang Life has also been helping South Korea attract the interest of Chinese companies and individuals by providing loans to them in South Korea.

Gu said that Tongyang Life applied the corporate culture and business concepts provided by Anbang Group. Tongyang Life introduced the flat and lean management structure of Anbang and tried to keep costs under tight control, while maintaining the size and quality of business, he said.

Tongyang has been able to attract more talent to join the company due to its innovative operations and management style.

According to an April 8 report from Reuters, at the beginning of this year 30 of the total of 50 employees of a Busan-based life insurance company resigned at the same time to join Tongyang.

Anbang's excellent corporate culture and its proactive and innovative management system, which offer a promising career, have been major draws for those employees who have joined Tongyang.

Experts say that Anbang's successful acquisition and operation of Tongyang not only represent the export of capital, but also the export of business concepts and management expertise, helping boost the image and efficiency of Chinese companies globally.

zhuanti@chinadaily.com.cn

(China Daily 09/03/2016 page14)