Indonesian banks given $3b loans from lender

The Xiamen branch of China Development Bank has issued $3 billion in loans to three Indonesian banks for infrastructure construction in the Southeast Asian country.

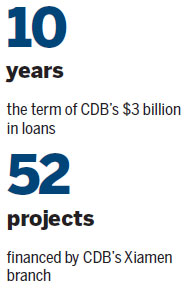

The 10-year loans, including the offshore RMB equivalent of $900 million, were granted to Bank Negara Indonesia, Bank Rakyat Indonesia and Bank Mandiri.

The project marks the first long-term major credit cooperation between financial institutions of the two countries.

One of the first projects listed on the Memorandum of Understanding on Cooperation between Leading Chinese Enterprises and Indonesian State-owned Enterprises, which was signed in the presence of both countries' top leaders in March 2015, it is expected to advance the development of the Belt and Road Initiative - the Silk Road Economic Belt and the 21st Century Maritime Silk Road projects proposed by President Xi Jinping in 2013.

CDB Chairman Hu Huaibang signed the memorandum with Rini Soemarno, Indonesia's minister of state-owned enterprises, in Beijing. Xi and Indonesian President Joko Widodo attended the signing ceremony.

To promote the project that has drawn attention from top leaders of both countries, CDB seized the opportunity generated by the changes in Indonesia's economic and financial conditions and explored cooperation with the three banks under Indonesia's Ministry of State-owned Enterprises.

On Sept 16, CDB and the banks reached a consensus after three days of negotiations and signed agreements on $1 billion in loans for a term of 10 years. CDB issued the loans in October, November and December.

The first long-term major credit collaboration between financial institutions of the two countries has set up a model for other cooperative projects. As Indonesia's foreign exchange reserves dwindle and the Indonesian rupiah faces the pressure of depreciation, CDB's large loans bolster the world's confidence in the Indonesian financial market and help the country stabilize its currency rates.

The move has also won trust from the Indonesian government and increased CDB's influence in the country's financial market.

The offshore RMB loans included in the agreements are expected to significantly popularize the use of the RMB in neighboring countries.

Over the past years, the CDB's Xiamen branch has made full use of its financial strength and expanded mutual beneficial cooperation in Indonesia to push forward the Belt and Road Initiative.

By the end of 2015, the branch had approved nearly $11.8 billion and some 6.8 billion yuan ($1 billion) in loans to 52 projects in Indonesia. More than $9.3 billion and 6.8 billion yuan in loans have been issued for those projects, which cover such sectors as finance, electricity, telecommunication, minerals, papermaking and agriculture. The outstanding loans stood at nearly $8 billion and 6.3 billion yuan.

zhuanti@chinadaily.com.cn

(China Daily 03/11/2016 page7)