As lottery luck wanes, NEV market prospects brighten

Legislators install measures to boost sales of green vehicles

When he heard the Beijing municipal government had plans to cut its annual license plate quota for gas-powered vehicles by about a third next year, Li Xinpeng said he was both shocked and dismayed.

"If that is true, I basically have no chance of getting a car," said the 31-year-old Beijing resident.

According to media reports in recent weeks, the Beijing government is likely to cut its current annual quota of 90,000 fossil fuel-powered cars to 60,000 next year in a move to reduce the city's worsening congestion.

Li is eager to buy a car. As the father of an 18-month-old son, he said a vehicle would make life a lot easier.

For the past three years, Li has dropped his name into the city's license plate lottery without any luck. For many Beijing residents, the chances of winning a coveted license are fading. In the latest round in October, only 0.51 percent of applicants won.

But in the past few months, policymakers, both nationally and regionally, have made several moves to promote the new-energy vehicle sector. The Beijing municipal government announced it will double its quota for new-energy vehicles to 60,000 units next year.

The State Council, China's cabinet, asked local governments earlier this year to call off purchase restrictions and remove traffic controls for NEVs.

"I understand the authorities want to popularize NEVs, but I wouldn't choose an electric car because its range is shorter than the average internal combustion engine and it often needs to be charged," Li said.

The quota policy for NEVs applies to several major cities, such as Beijing and Shanghai, but many believe it needs to be improved.

The lack of a national standard is often cited as one weakness. Currently, every city sets its own policy. Beijing, for example, only greenlighted plates for pure electric cars, while Shanghai offers licenses for both pure electric and hybrid vehicles.

Moreover, purchase options for customers are limited. In Beijing, only a dozen pure electric models are on the availability list for the NEV license lottery.

Nevertheless, China's NEV market has surged over the past two years thanks to strong governmental support and purchase restrictions on gas-powered vehicles in major cities.

Upward swing

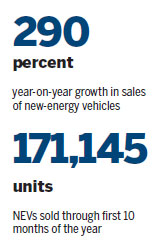

According to the China Association of Automobile Manufacturers, sales of NEVs surged 290 percent year-on-year to 171,145 units in the first 10 months of 2015, with pure electric vehicles accounting for the majority of sales.

Industry experts said with a boost in sales, automakers in China will make great efforts to develop the NEV market.

Namrita Chow, principal analyst at HIS Automotive, said last month that automakers in China are keen to emphasize their allegiance and adherence to the government's NEV goals.

"The Chinese government is on a drive to clean up the country by reducing pollution and showcasing itself as a leader in new, clean energy-related technologies," Chow said.

This year, eight local automakers, including SAIC, Dongfeng, Changan and Geely, announced they are advancing their research and development of NEV models in the near future.

Changan said it is set to produce 34 NEV models, the most ambitious plan among the carmakers. The company plans to sell 400,000 NEV vehicles by 2020.

SAIC plans to reach a sales goal of 600,000 NEV units by 2020, one-third of which will come from China's self-owned brands.

Geely plans to turn 90 percent, or a million units, of its total production into new-energy cars by 2020.

GAC said it aims to sell 200,000 new-energy vehicles by 2020.

At last month's Guangzhou Auto Show, 60 new-energy models were presented from a raft of automakers including Volkswagen, Mercedes, General Motors, Toyota, Changan, Dongfeng, BYD and BAIC.

Ouyang Minggao, a professor from Tsinghua University and a specialist on new-energy vehicles, said at an auto show forum last month that there are many challenges for China's NEV industry, including a high reliance on government incentives, safety problems with batteries and fierce international competition.

He suggested automakers gradually wean themselves from incentives and pay more attention to research and development of NEVs.

Zeng Qinghong, general manager of GAC, said automakers should break away from their dependency on incentives. The priorities, he said, should be to improve the quality of batteries and the infrastructure of charging facilities.

Zeng suggested establishing a new-energy credits collection system, which could apply to the production, charging and trade of NEVs. In his theoretical plan, automakers would owe credits for gasoline vehicles they produce and sell. This would complement a sales quota on zero-emission vehicles imposed on automakers.

Ouyang said he thinks more and more customers will buy new-energy cars because policies will continue to support the industry, the cost of NEV batteries will drop and the construction of charging facilities will speed up.

He said the market should be able to reach the central government's goal, established in 2012, of having 5 million new-energy vehicles on roads by 2020. He also said fuel-cell cars will hit the market in 2020.

duxiaoying1@chinadaily.com.cn

|

A woman charges her electric vehicle, which has a Shanghai license plate, on an expressway in Dingyuan, Anhui province. Major cities across China currently have diff erent policies on new-energy vehicles and diff erent standards for charging facilities. Song Weixing / For China Daily |

(China Daily 12/07/2015 page18)