Demand expected to grow for small-engine, new-energy cars

As the country's government gears up to meet its 2020 targets, emphasis is being put on automakers to adhere to the trend for cleaner emissions with new-energy vehicles.

The Chinese government is on a drive to clean up the country through reduced pollution and to showcase itself as a leader in new, clean-energy-related technologies.

Automakers in China are keen to emphasize their allegiance and adherence to the government's targets and the upcoming Guangzhou motor show will be a stage for clean emission and zero emission vehicles, as well as those with engines of under 1.6 liters.

A new government policy, which came into effect on Oct 1, offers a 50 percent reduction in the new vehicle purchase tax for cars with engines no larger than 1.6 liters, bringing it down to 5 percent.

The policy is expected to be effective only through the end of 2016, and has already helped leverage passenger vehicle sales growth in China, with October sales up 10 percent from September.

The upcoming 13th Five-Year plan (2016-2020) is expected to reaffirm the government's targets for 5 million new-energy vehicles to be in use in the country by 2020, with annual production of 2 million electric vehicles.

A draft of the policy has been released and shows that significant emphasis is being spent on approving EV charging infrastructure, EV battery production and EV production in China.

Automakers have indicated that at the Guangzhou motor show they will showcase models specifically in the new-energy vehicle segment, as well as those fitted with small engines.

IHS Automotive forecasts also highlight that demand for small-engine vehicles will continue in China - even after the expiration of the new purchase tax cut, as automakers will have to meet the country's new corporate average fuel economy requirements.

Volkswagen is expected to show 36 models in its 3,430-square-meter stand with a specific spotlight on NEVs.

The automaker has stated that at the Guangzhou motor show it will be "showcasing the technologies and vehicles that will transport Chinese drivers into tomorrow - the spotlight will be on Volkswagen's innovation in new-energy vehicles".

Jochem Heizmann, president and CEO of VW Group China, said, "With China being Volkswagen's most important market worldwide, we are forging ahead with e-mobility solutions to meet the needs of our customers. At this year's auto show in Guangzhou, the Volkswagen brands will not only be showcasing full electric vehicles like the e-Golf but also the GTE badged plug-in hybrids, as we commit to being at the forefront of electrifying China."

The second trend, of small-engine vehicles, is also a major focus for VW, with small-engine models sitting side by side with NEVs.

"Efficient cars featuring high-tech, compact, turbocharged TSI engines will sit alongside GTE models," the automaker stated. VW will introduce three new models at the auto show, an imported model and one each from VW's joint ventures in China, FAW-Volkswagen and Shanghai Volkswagen.

Toyota said it will showcase 30 models at the Guangzhou motor show with half of these being models that highlight the NEV trend, including locally produced hybrid vehicles. Toyota will also show EVs, such as the FT-EV III concept and the company's latest plug-in hybrid electric vehicle concept, the NS4.

Geely will also display its allegiance to the trend, according to company vice-chairman Yang Jian. He said most Geely models in the future will be offered in hybrid, PHEV and battery EV variants.

Outlook and implications

IHS Automotive forecasts for vehicles with zero emissions show that there will be a steady increase in the volume of these vehicles produced and sold in China.

However, they continue to account for only a small fraction of the overall light-vehicle market in the country.

China is, however, going through a change with smaller-engine vehicles gaining traction in the market, a trend that is set to remain even after the expiration of policies currently in place promoting sales of vehicles with small engines.

The main reason for this is the tougher corporate average fuel economy requirements set by the Chinese government for the 2015-2020 period.

Growth of small-engine models in China also sheds light on the continued and increased use of turbochargers by automakers as Chinese consumers' appetite for sport utility vehicles is not expected to abate.

Current IHS Automotive forecasts for light-vehicle production in China indicate that the total light vehicle market will grow by single-digit rates, with volume rising to more than 25.4 million vehicles in 2017 and 29.6 million produced in 2020.

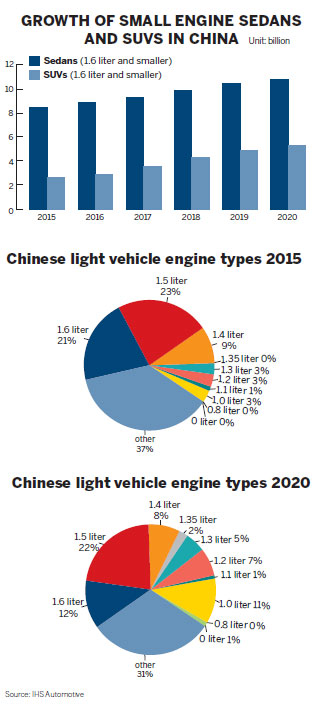

Within this vast volume, the proportion of vehicles with smaller engines will rise. In 2015, the volume of vehicles in the Chinese light-vehicle market fitted with small engines (1.6 liters and smaller) accounted for about 63.08 percent of the total light-vehicle market. By 2020, vehicles with smaller engines are expected to account for 68.8 percent of the light-vehicle market in China, according to IHS forecasts.

Within this increase in market share for vehicles with smaller engines, the level of zero emission vehicles, or pure EVs, is expected to remain at fewer than 40,000 units per annum, but the number of SUVs with small engines is expected to significantly increase, while sedans with small engines will rise, but not as fast as the SUV growth rates.

From a volume perspective, however, the small engine sedan will have the largest volume share of the light vehicle market in China.

In 2015, IHS Automotive forecasts are that 2.67 million SUVs with engines of 1.6 liters and smaller will have been produced in China. In subsequent years, this segment will grow by double-digit rates, rising by more than 21 percent year-on-year in 2017.

The growth rate is then expected to slow, but volume will continue to rise with the segment rising to more than 5 million units in 2020.

Meanwhile, as this small engine SUV segment increases market share in China, production of sedans with small engines will also rise, albeit at a much slower growth rate of single digits.

In 2015, this segment will account for about 8.5 million units, and will rise to 10.8 million units by 2020, IHS forecasts show.

The author is principal analyst at IHS Automotive.

|

The Lamborghini SUV Urus, which redefines dynamics and design in the super SUV segment, is going to hit the road in 2018. |

(China Daily 11/20/2015 page19)