Market feels global chill

New-energy vehicles provide reassurance in otherwise sluggish demand

Despite the summery weather in South China, the annual automotive show in Guangzhou has felt some chill from the slowdown of the world's largest auto market.

The event, with "New Technology, New Life" as its theme, is showcasing 1,000 vehicles this year, 36 of them having global premieres, according to the organizers.

Information on the event's website shows that automakers worldwide exhibited 1,079 cars, with 56 global premieres, at last year's show.

The comparison comes as no surprise to many industry insiders considering the auto market's sluggish performance this year.

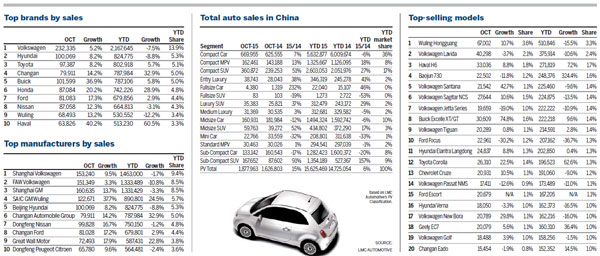

Auto sales in China grew a mere 1.5 percent year-on-year in the first 10 months. That growth rate was even lower before the central government gave a helping hand in late September by halving the tax on purchases of passenger vehicles with engines that are 1.6 liters or smaller.

"It is clear that the State Council's stimulus policy has worked effectively," said Dong Yang, executive vice-president of the Chinese Association of Automobile Manufacturers, at a news conference in early November.

The association's statistics show that 1.33 million vehicles with such engines were sold in October, a 16.3-percent growth from September, accounting for 69 percent of all passenger vehicles sold that month.

Even with the stimulus policy, Dong was uncertain if the overall market's growth rate this year would meet the association's estimated 3 percent growth year-on-year.

At the start of 2015, the association expected the Chinese auto market would grow by 7 percent, almost the same as in 2014, but the sluggish performance in the first half of the year forced the organization to slash its forecast to 3 percent in July.

Factors blamed for the poor sales vary - China's overall downward economic pressure or the turbulent stock market earlier this year - but one thing everyone agrees is that nobody predicted this scenario at the start of the year.

"We did not anticipate sales would fall into such a situation," said Shi Jianhua, the CAAM's deputy secretary-general.

"Our estimated 7-percent growth year-on-year was based on the opinions of major carmakers in the country."

Amid the sluggish market, the ministry of industry and information technology on Nov 12 announced 14 domestic carmakers would close their businesses soon and more are expected to do so.

Miao Wei, minister of industry and information technology, indicated that Chinese carmakers are far from competitive. "There are 184 local players, so we will continue our pace to reshuffle the market and eliminate those unqualified players," he said.

He also urged Chinese carmakers to upgrade their technology and launch industrial restructuring soon.

"If they can't catch up to speed, a new industrial shakeup is ready," he said.

NEV boom

New-energy vehicles, however, offer a different and reassuring story despite the overall slowdown of China's auto market.

Through the first 10 months, China sold 171,145 new-energy vehicles, a 290-percent rise from the same period last year, with pure electric models taking up a majority of that figure.

More evidence for new-energy vehicles' popularity in China is that five out of 10 best-selling models worldwide in September were from Chinese carmakers - Geely's electric Panda, BYD's Tang and Qin, BAIC's E series and SAIC's Roewe 550 - according to a report by news portal OFweek.

BYD's Qin ranked fourth and BAIC's E series ninth among the top 10 global bestsellers in the first three quarters of the year, the report said.

International automakers are also stepping up their efforts in the new-energy vehicle segment.

Volkswagen said it would locally produce more than 15 different models of plug-in hybrids or fully battery-powered cars within four years, with production expected to start in 2016.

Ford will introduce two new-energy vehicles - the C-Max Energi and the Mondeo hybrid - to the Chinese market from 2016, the US automaker's CEO Mark Fields said last month in Shanghai.

Mercedes-Benz's parent company Daimler rolled out an electric model called Denza with its Chinese partner BYD late last year.

BMW is selling i3 and i8 new-energy vehicles, as well as the Zinoro from its joint venture BMW Brilliance in the Chinese market.

Auto shows are dedicating separate halls to new-energy cars. Organizers of the Guangzhou auto show have doubled the floor space to 20,000 square meters for such cars and visitors to those halls are exempt from ticket charges.

"The Chinese market has seen rapid growth since 2014. We predict that the next five to 10 years will be an important phase for the industry," said Jin Jun, a PwC China advisory partner.

The central government is continuing its support of the sector. In late September, the State Council gave orders that local governments must not restrict the sales or use of new-energy cars.

That same month, it issued a document that aims to improve battery charging networks and infrastructure. An inadequate number of charging stations is seen as a major hurdle to the sales of new-energy vehicles in China.

The sector is expected to gain momentum further as the Central Committee of the Communist Party of China suggested writing into China's 13th Five-Year Plan (2016-2020) wording to boost technological innovations in the manufacturing of new-energy vehicles and the promotion of their use.

PwC estimates the sales of new-energy vehicles in China will rocket to 1.4 million units by 2020, about 20 times the number of sales in 2014, and to about 3.75 million units by 2025.

Contact the writers through lifusheng@chinadaily.com.cn

Yang Cheng contributed to this story.

|

A child plays at an automotive show in Nanjing in October. To energize a sluggish Chinese auto market, the government created stimulus policies to boost the traditional auto and newenergy vehicle markets. Provided To China Daily |

(China Daily 11/20/2015 page17)