Bank of China has strong presence in London

First opened in 1929, its branch there focuses on developing high-end financial products to meet often diversified demands and characteristics.

Bank of China Ltd continues to enhance its competitiveness in the United Kingdom to serve China's development strategies and boost bilateral trade, both of which are being afforded greater opportunities by the acceleration of renminbi internationalization and the country's continued global expansion.

In recent years, a growing number of Chinese companies have selected the UK as their key investment destination as the two countries develop closer economic and trade relations.

During that process, Bank of China - the nation's fourth-largest lender by assets - has been able to provide them with a comprehensive range of financial services in London, backed up by its growing global operations.

First opened in 1929, the London branch is concentrated, particularly, on developing high-end individualized financial products to meet often diversified demands and characteristics of clients.

Benefiting from London's rich banking and financial heritage, the branch's services include company valuations for mergers and acquisitions, financing scheme design, debt issuance and structured finance, all of which are linked strongly to its abilities to act as an international fundraising channel, both into and out of China.

It can handle many other different commercial and investment banking needs, also, including insurance services, at various stages of the business life cycle.

Over the past two years, customers have also been served by its growing network of sub-branches across the UK.

Chinese clients, rising annually by around 90 percent in number in recent years, now contribute to nearly half of the main London branch's average annual growth.

Of the headline deals it has helped finance in the UK, it worked with Nanjing Xinjiekou Department Store Company to buy an 89-percent stake in Highland Group Holdings Ltd, the owner of British retailer House of Fraser Plc, in a deal valuing the group at 480 million pounds ($742 million) in 2014.

It also played a key role in helping PetroChina Company Ltd, the nation's largest oil producer, complete a $ 1 billion acquisition of a 50-percent stake in UK-based Ineos Group Holdings Plc's European refining business, including plants in Scotland and France in 2011.

For Bright Food Group Co Ltd, the Chinese food and beverage producer, it worked closely on its nearly-700 million pound acquisition of a 60-percent stake in breakfast cereal manufacturer Weetabix Ltd, which it had previously provided with 500 million pounds of debt finance.

A particular aim of Bank of China's expansion plans in the UK is working with more Chinese and UK small-and medium-sized enterprises.

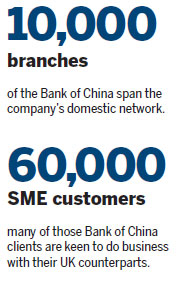

The company has a domestic network in China of more than 10,000 branches and 60,000 small and medium business customers, many of whom are keen to do business with their UK counterparts.

The bank will hold a China-UK SME Business Matchmaking Event in Manchester on Friday, offering an ideal opportunity for high-quality small businesses from both countries to find joint-development opportunities.

This model for raising cross-border matchmaking activity has already helped many Chinese SMEs improve their technical knowhow, widen their market horizons,and accelerate their transformation and upgrading.

Of course, as a London branch, the outlet is also ambitious to improve its local-client base across the UK, offering services which can complement the nation's mainstream commercial lenders.

Local account holders already account for 80 percent of total client numbers, 70 percent of whom are individuals. Large corporate clients based in the UK and Europe accounted for nearly half of its corporate clients.

Acting as the only Chinese commercial lender involved, for instance, Bank of China participated in a syndicated loan for a train manufacturer involved in the Thameslink Program, a major project to transform north-south travel through the UK capital city.

It also arranged a $500 million syndicated loan for a Sino-Russian joint venture in Kazakhstan, which expects to export about 2 million metric tons of crude oil to China.

With London very much its base in Europe, the bank has provided numerous European companies with an integrated financial services platform for their expansions into China also.

In the past six years, the London operation has been core to the internationalization of the renminbi, and to supporting London's development as an offshore trading hub for the Chinese currency, offering innovative offshore renminbi products and developing a more rational system for pricing renminbi products.

Since China launched its pilot program for renminbi settlement for cross-border trade transactions in July 2009, a comprehensive range of renminbi products and services have been launched to target corporate, individual and institutional customers.

After issuing a 2.5 billion yuan ($394 million) renminbi bond in London in January 2014, it was then appointed by the UK government as one of the three joint lead managers for the world's first non-Chinese sovereign offshore renminbi bond issuance, in October last year.

The bank created a dedicated commodity business center in London in December 2014, and two months later, it finalized a 2.75 billion yuan deal with British Airways for the purchase of two Airbus A380 superjumbos, arranging yuan-denominated financing facilities.

In July this year, the London branch became the first Chinese settlement bank for LME Clear, the clearing house for the London Metal Exchange, providing renminbi clearing services for the exchange.

It established a trading center in London on Tuesday (Oct 20) to further promote growth in spot and forward transactions, as well as swaps, between renminbi and foreign currencies in the European market.

As the Bank of China Group's second-largest offshore trading center after Hong Kong, the center reinforces the group's global business network, and provides clients with greater coverage in foreign exchange, derivatives, commodities and fixed income trading.

jiangxueqing@chinadaily.com.cn

|

The office building of Bank of China, London branch. Photos Provided to China Daily |

|

British car brand Land Rover signs a memorandum of understanding with Bank of China recently. |

(China Daily 10/21/2015 page12)